How to optimize family office ROI with AI

AI to boost family office returns, streamline ops, improve risk management and guide deeptech investing with clear ROI and data governance.

How to optimize family office ROI with AI

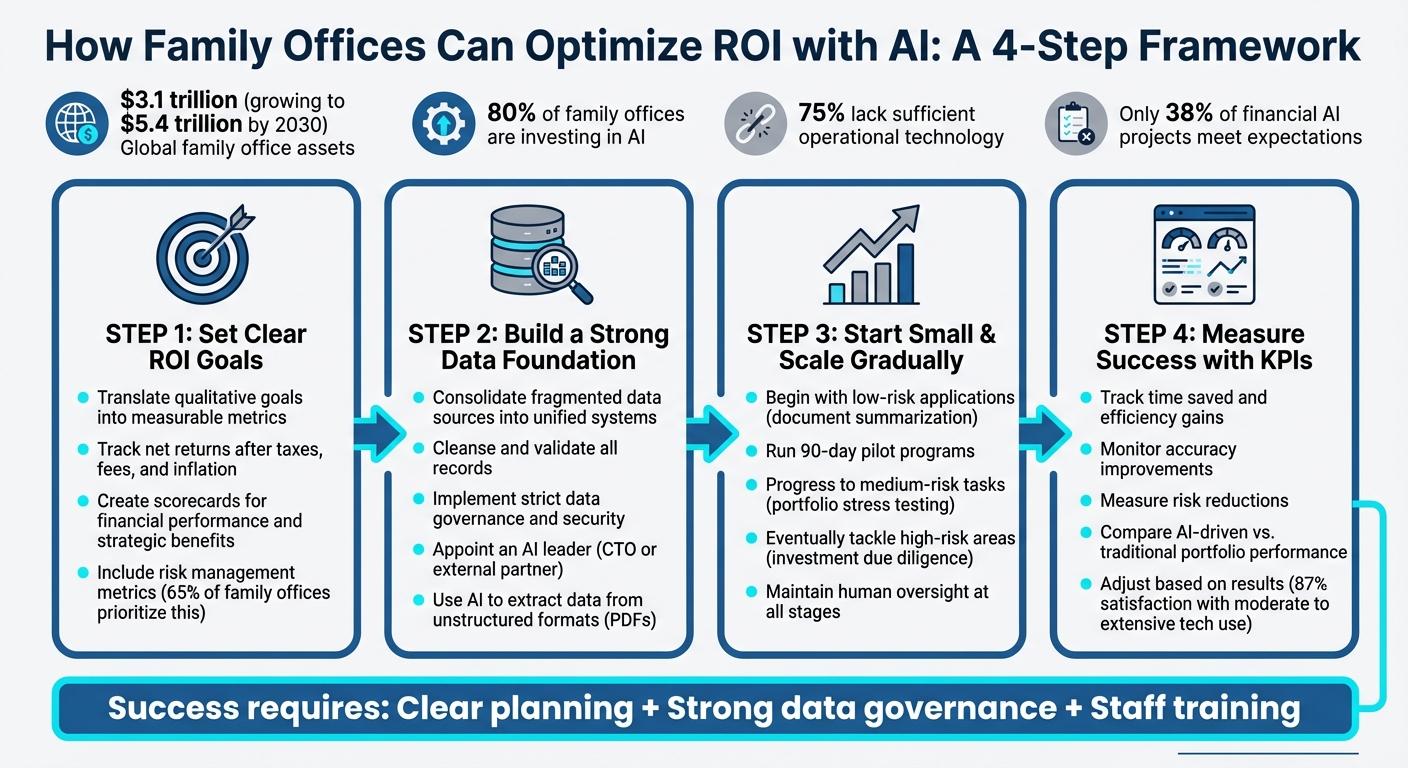

AI is transforming how family offices manage wealth, offering tools to improve returns, streamline operations, and handle complex portfolios. Here’s what you need to know:

- Family offices oversee $3.1 trillion globally, expected to grow to $5.4 trillion by 2030. They allocate 40%-55% of portfolios to illiquid assets like real estate and private equity, creating unique challenges.

- 75% of family offices lack sufficient operational technology, but 80% are investing in AI to improve data management, predictive analytics, and decision-making.

- AI helps by:

- Organizing fragmented data for better insights.

- Enhancing risk management with real-time monitoring and predictive models.

- Automating routine tasks like reporting and document classification.

- Supporting long-term investments in areas like deeptech with tailored analysis.

To succeed with AI, family offices must:

- Set clear ROI goals tied to measurable outcomes like net returns or efficiency gains.

- Build a strong data foundation, consolidating key information into unified systems.

- Start small with low-risk AI applications, gradually scaling up while ensuring human oversight.

- Measure success with specific KPIs, such as time saved, accuracy improvements, or risk reductions.

While AI adoption offers immense potential, only 38% of financial AI projects meet expectations, often due to poor governance or unclear objectives. Clear planning, strong data governance, and staff training are critical for success.

4-Step Framework for AI Implementation in Family Offices

The Family Office That Never Sleeps

Setting ROI Goals and Preparing Your Data for AI

Before introducing AI tools, family offices must translate their long-term aspirations into measurable goals and organize their essential data. As of 2024, 43% of family offices are either developing or implementing a technology strategy. However, only 30% report achieving meaningful results, such as improved efficiency or cost savings, from operational technologies [11]. This gap often stems from unclear objectives and disorganized data. Defining clear ROI targets and building a strong data infrastructure are crucial first steps for integrating AI into family office operations.

Define ROI for Your Family Office

Family offices often gauge success through qualitative goals like preserving a legacy or ensuring multi-generational stewardship. But to effectively use AI, these broader aspirations need to be translated into specific, measurable metrics. Start by aligning family objectives with tangible financial outcomes, such as net returns after taxes, fees, and inflation, across various asset classes. For example, if your family office emphasizes alternative investments like private equity or real estate, track how AI-driven insights influence net returns in these areas compared to more liquid investments.

Create a scorecard that monitors both financial performance and strategic benefits, such as time saved or faster decision-making. As PwC points out:

"The ROI of AI isn't always captured in spreadsheets. It's found in reclaimed time, improved insight, faster decisions and a more adaptive culture" [2].

With investment returns for family offices projected to average 5% in 2025 - down from 11% in 2024 - efficiency gains become increasingly important [10]. Additionally, considering that 65% of family offices prioritize improving security and risk processes through technology, incorporating risk management metrics into your ROI framework is essential [11].

Once your ROI goals are clearly outlined, the next step is building a clean and unified data infrastructure to support AI deployment.

Build a Data Stack for AI

AI can only deliver meaningful insights when it has access to clean, well-organized data. Many family offices struggle with fragmented information spread across custodian platforms, private bank portals, fund administrator reports, and outdated spreadsheets. As Manju Jessa, Vice President & Head of Family Office and Strategic Clients at RBC, explains:

"Technology adoption is advancing in family offices, particularly for automated reporting and research, delivering gains in efficiency, insight and decision-making speed" [10].

To address this, consolidate key data sources - such as portfolio returns, tax records, brokerage statements, and deal documents - into a single, reliable system. Leverage AI to extract and standardize data from unstructured formats like PDFs, enabling analysis across different asset classes. Techniques like Retrieval-Augmented Generation (RAG) can help validate AI outputs and minimize errors in data matching [5].

Ensure your records are thoroughly reviewed, cleansed, and validated. As RSM advises:

"AI-enabled insights will only be as reliable as the integrity - and ready availability - of core records such as entity structures, ownership details and capital account data" [7].

Appoint an AI leader, whether it’s an internal Chief Technology Officer (CTO) or an external partner, to oversee data governance, privacy, and security. Implement strict system permissions to prevent accidental exposure of sensitive family data, and establish clear policies to prohibit staff from uploading confidential documents into public AI tools [4][7].

With well-defined ROI metrics and a solid data foundation, family offices can position themselves to harness AI's full potential for precise and actionable insights.

AI for Portfolio Optimization and Risk Management

With a solid data infrastructure in place, AI can revolutionize how portfolios are managed, offering a new level of precision and foresight. By processing an immense range of data - spanning geopolitics, social sentiment, and more - machine learning uncovers relationships that traditional models often overlook. This shift enables family offices to move beyond periodic reviews and embrace continuous, proactive monitoring, identifying risks before they materialize. When built on a strong data foundation, AI tools become powerful allies in optimizing returns and managing risk effectively.

Forecast Returns and Risk with AI

AI brings a fresh perspective to risk analysis by examining multiple dimensions at once. Instead of relying solely on historical trends, predictive models tap into real-time data sources like news feeds, earnings call transcripts, and regulatory filings. These models, often powered by Natural Language Processing (NLP), sift through unstructured data to detect subtle market signals, offering early warnings of potential price swings before they are fully reflected in the markets.

AI also stress-tests portfolios against a variety of market scenarios - whether it's interest rate hikes, liquidity crunches, or sector-specific disruptions. Tools like Conditional Value at Risk (CVaR) and Max Drawdown simulations provide insights into potential losses during extreme events. For example, in 2025, RTS Labs helped a financial client achieve a 23% increase in net profit by using predictive analytics to identify key financial drivers and customize risk-model inputs [13].

Another game-changer is AI’s ability to trigger alerts when Value-at-Risk (VaR) thresholds are crossed. As Michael Flatley, Vice President and Wealth Advisor at Farther, puts it:

"AI helps eliminate emotional decision-making by relying purely on data" [12].

This data-driven approach minimizes behavioral biases, such as recency bias or herd mentality, which often lead to poor decisions during market downturns.

Rebalance Your Portfolio with AI

Traditional portfolio rebalancing typically follows rigid schedules - quarterly or annually - without accounting for real-time market dynamics. AI disrupts this outdated process by continuously monitoring portfolio drift and recommending adjustments when predictive indicators signal a significant imbalance.

AI-powered rebalancing tools can juggle multiple constraints simultaneously, optimizing for objectives like maximizing returns while considering tax implications, liquidity requirements, and ESG mandates. For instance, portfolios that incorporate AI-driven tax-loss harvesting have achieved up to 30 basis points (0.30%) in additional annual after-tax returns compared to traditional methods [13]. These systems also identify the most cost-efficient trade routes, minimizing transaction costs and market slippage.

Here’s a quick look at how AI-driven rebalancing stacks up against traditional methods:

| Aspect | Traditional Rebalancing | AI-Driven Rebalancing |

|---|---|---|

| Frequency | Fixed intervals (e.g., quarterly or annually) | Continuous, real-time monitoring |

| Triggers | Manual review or simple percentage drift | Predictive indicators and market volatility forecasts |

| Execution | Slower cycles; prone to market slippage | Rapid execution; identifies optimal trade routes |

| Data Input | Historical metrics and analyst opinions | Real-time news, sentiment data, and macro feeds |

| Bias | Susceptible to emotional decision-making | Disciplined, data-only approach |

One effective strategy is threshold rebalancing, where AI monitors 5% bands around target weights. This method often outperforms periodic rebalancing by reducing unnecessary trades, which helps cut costs [14]. However, it’s crucial to maintain human oversight for final decisions. As RSM advises, distinguish between low-risk applications like document summarization and high-risk tasks such as automated trade recommendations, ensuring an appropriate level of review for each [2].

sbb-itb-5766a5d

AI for Deeptech Investment Strategies

Deeptech investments - covering areas like quantum computing, biotechnology, and semiconductors - are reshaping the landscape for family offices. These sectors come with their own set of challenges, including long development timelines (often 5–10 years) and the need for highly technical evaluations that go beyond traditional due diligence methods[16]. Here's where AI steps in, offering the ability to process vast datasets, uncover emerging trends, and identify hidden market signals that might otherwise be overlooked. For instance, in 2024, deeptech led venture capital funding, and by 2025, AI startups raised $192.7 billion, representing the lion’s share of VC investments. This underscores the growing need for advanced tools to separate meaningful advancements from overhyped claims[16][18].

Family offices are particularly well-suited to thrive in this space. Unlike traditional venture capital firms that operate under fund lifecycle constraints, family offices can deploy patient capital, aligning perfectly with deeptech's extended R&D cycles[16]. However, success here isn’t just about having the money - it’s about identifying promising opportunities early and structuring investments to minimize risks, both technical and market-related. This is where tailored AI tools come into play, offering family offices a strategic edge in managing deeptech investments.

Use Innovation Lens for Deeptech Research

Innovation Lens provides family offices with a specialized tool to pinpoint transformative opportunities in deeptech. By leveraging predictive analytics, this platform sifts through millions of research studies weekly, identifying trends in areas like AI, quantum computing, and biotechnology that signal future commercial potential. It taps into alternative data sources such as academic papers, patent filings, and activity from research institutions to uncover promising, underexplored investment opportunities[3].

The platform simplifies complex data, offering curated reports that deliver actionable insights. This addresses the challenge of synthesizing large volumes of unstructured data, something traditional methods often struggle with[4]. For example, AI-driven due diligence tools can cut analysis time by up to 40%, streamlining the evaluation process[16]. Additionally, Innovation Lens provides customizable recommendations tailored to specific investment goals, whether that’s advancing climate technology, semiconductor breakthroughs, or next-generation therapeutics.

Family offices can also integrate Innovation Lens directly into their existing workflows through API access, enabling continuous monitoring of portfolio companies and adjacent technologies. With a 79% increase in AI startups achieving unicorn status in 2024 compared to the previous year, early recognition of technical milestones is critical for capturing outsized returns[19]. These insights empower investors to take a disciplined approach, balancing risk and return in deeptech investments.

Balance ROI and Risk in Deeptech Investments

Deeptech investments come with unique risk-return profiles, often marked by long development cycles and limited liquidity. AI can support family offices by modeling the "Productivity J-curve", which highlights the initial adaptation costs before efficiency gains kick in. This allows for staged investments tied to key technical and regulatory milestones[18]. While 84% of organizations investing in AI report achieving ROI[15], a striking 95% still fail to realize meaningful returns[17], highlighting the importance of strategic execution to bridge this gap.

AI-powered scenario modeling is another valuable tool, enabling family offices to stress-test their deeptech portfolios against potential challenges like technical failures, regulatory hurdles, or competitive pressures. For perspective, companies heavily investing in AI report 82% higher revenue and 53% higher gross profit compared to those that don’t, though these gains often require sustained investment throughout the J-curve phase[17].

When constructing a deeptech portfolio, liquidity considerations are crucial. A balanced approach might involve splitting allocations between long-term deeptech ventures (with horizons of 5–10 years) and shorter-term, profitable investments. This ensures not only the ability to meet operational needs but also the flexibility to seize new opportunities as they arise[16].

Improve Operations and Governance with AI

AI is changing how family offices operate, making everyday tasks more efficient and reliable. In 2025, three times as many family offices are using AI to enhance operations compared to 2024 [10]. With a growing focus on streamlining processes, many offices are moving away from manual spreadsheets to automated systems, freeing up staff to focus on more strategic tasks. Beyond efficiency, AI is also improving governance and boosting staff capabilities.

Automate Routine Tasks

AI takes over many time-consuming, repetitive tasks, saving hours of staff effort each week. For example, in accounting, AI automates transaction classification, reconciliations, and anomaly detection, significantly speeding up the monthly financial close process [7]. In bill payments, Optical Character Recognition (OCR) technology processes invoices and validates payments automatically [4][7].

Investment reporting is another area where AI has gained traction. In 2025, 69% of family offices are using automated investment reporting systems, up from 46% in 2024 [10]. These systems extract transaction data directly from brokerage statements and Schedule K-1s, transforming unstructured data into structured formats that integrate seamlessly with accounting systems [4][5]. A great example is Risclarity, a tech firm that introduced an AI-powered data entry system for family offices. This system uses Retrieval-Augmented Generation (RAG) to validate security names against a verified database, allowing analysts to process statements from multiple banks with minimal manual effort. The result? Faster reporting and fewer errors [5].

Document management also benefits from AI. Tools that classify and summarize legal, tax, and investment documents make it easier to organize and retrieve critical information [5][7]. For investment memos, AI gathers and synthesizes market and sector data into standard formats, speeding up due diligence [2]. However, human oversight remains essential - AI serves as a tool to assist, not replace, decision-making. Staff review and approve all outputs to ensure accuracy and reliability.

"Generative AI streamlines routines and boosts high-value work." - Manju Jessa, Vice President & Head of Family Office and Strategic Clients, RBC [10]

Create AI Governance and Build Talent

While automation brings efficiency, strong governance ensures these tools are used responsibly. For family offices, adopting AI effectively means setting up clear frameworks and training the right people to manage these tools. A solid governance framework should cover five key areas: data integrity, permissions and access control, retention and privacy policies, explicit AI use guidelines, and vendor risk management [7]. For instance, staff should avoid uploading confidential reports to public AI models like the free version of ChatGPT to prevent data leaks [7][3]. Permissions should also be carefully configured to limit access to sensitive financial data [7].

It’s important to distinguish between low-risk uses of AI, such as document summarization, and high-risk applications like automated trading or client-facing tools. Each requires a different level of oversight [2]. When working with vendors, review contracts to ensure that your data isn’t used to train public AI models, and choose vendors offering zero-retention configurations whenever possible [7]. Before deploying AI, ensure your foundational data - like entity structures and ownership records - is accurate, as AI outputs are only as good as the data they rely on [7].

Training your existing team can go a long way. With just a few hours of guided instruction, staff members can become comfortable using AI tools [2]. Currently, 43% of family offices are developing or implementing a technology strategy, often led by a designated leader such as a Chief Information Security Officer (CISO) or an external technology partner [8][4]. For specialized tasks, consider hiring tech-savvy analysts to handle areas like risk management, investment sourcing, and due diligence [6].

"It's less about AI agents replacing staff and more about staff configuring and overseeing AI tools while keeping the human connection at the center." - RSM [7]

AI doesn’t replace your team - it enhances their abilities. Younger generations, particularly Millennials and Gen X, are leading the charge in AI adoption. In fact, 74% of next-gen family members trust AI for wealth management decisions, as long as humans remain involved in the process [6]. By investing in digital skills and establishing clear governance, family offices can create a collaborative environment that embraces AI while maintaining human oversight.

Measure and Improve AI-Driven ROI

To gauge the true impact of AI, it's essential to look beyond standard performance metrics. Investment-focused KPIs should highlight opportunities for better returns and improvements in portfolio performance [3][6]. On the risk management side, metrics could include AI-flagged scenarios that help prevent cybersecurity breaches or investment fraud [3][6]. Operational efficiency can be assessed by tracking time savings and cost reductions [2][4][7], while financial KPIs should reflect lower operational costs and more precise cash flow predictions [2][3][11].

Interestingly, 38% of family offices report gaining notable value from operational technologies designed to enhance controls and mitigate risks. Meanwhile, 30% point to improved efficiency and cost savings as key benefits [11]. However, 17% of family offices identify insufficient investment in technology as a significant operational risk [11].

Set KPIs for AI Projects

To ensure AI initiatives succeed, it’s crucial to define specific KPIs tailored to each application area. Start by establishing benchmarks before rolling out any AI tools. For investment performance, track how many alpha-generating opportunities AI identifies and compare the results of AI-driven portfolios to traditional ones [3][6]. In risk management, focus on how often and accurately AI flags potential issues and how effective it is in stress-testing portfolios against economic or political changes [3][6]. For operational efficiency, measure time savings by comparing manual processes to AI-enabled workflows or analyzing how much analyst time is freed up from routine tasks [2][4][7].

Comparing results before and after AI implementation can reveal its true value. For example, one family office managed to cut risk exposure by 23% with minimal portfolio changes [9]. Additionally, using AI to identify behavioral biases has been shown to improve the quality of investment decisions by up to 31% [9].

These KPIs create a solid foundation for scaling AI initiatives effectively and safely.

Scale Successful AI Initiatives

Once KPIs are in place, the next step is to scale AI projects gradually, using measured success as a guide. Start with low-risk applications, such as summarizing research or classifying documents, to achieve quick wins. These tasks can save time, reduce errors, and build trust in the technology. Once confidence is established, move on to medium-risk tasks like portfolio stress testing, and eventually tackle higher-risk areas such as investment due diligence [2].

For new AI tools, consider running 90-day pilot programs with clear success metrics and integrated staff training [1]. Throughout the scaling process, human oversight remains essential - AI should support, not replace, human decision-making [2][6]. Assign a dedicated individual to oversee the adoption process, collect feedback, and monitor AI performance [1].

Family offices that take this cautious, step-by-step approach report higher satisfaction levels. In fact, 87% of moderate to extensive technology users express satisfaction, compared to just 66% of those with minimal technology adoption [11]. It’s worth noting that only 38% of AI projects in finance deliver the anticipated ROI, making careful monitoring and incremental scaling absolutely critical [1].

FAQs

How does AI help family offices improve risk management?

AI is transforming risk management for family offices by offering a more thorough and forward-looking approach. By merging financial, operational, and ESG data from various systems into one unified platform, it provides decision-makers with a clearer view of potential risks. Using machine learning, it can analyze this data to detect irregularities, like unusual trading behaviors or early indicators of market instability, enabling faster responses to potential threats.

On top of that, AI-driven predictive analytics and scenario modeling help family offices evaluate the effects of economic changes, new regulations, or industry disruptions. This automation not only minimizes manual mistakes but also allows analysts to devote more time to strategic planning and addressing potential risks.

AI also plays a crucial role in bolstering cybersecurity and ensuring compliance. It continuously scans for suspicious activities, such as potential breaches or regulatory violations. With real-time alerts and automated reporting, family offices can stay agile, meet compliance standards, and maintain resilience in a constantly shifting landscape.

What are the key steps for family offices to successfully implement AI?

To effectively integrate AI, family offices should kick things off with a readiness assessment. Take a close look at the existing data infrastructure, technology stack, and team expertise. This step is crucial for spotting any weaknesses in areas like data quality, security, or technical skill sets. Based on these findings, you might discover the need for improvements such as adopting cloud storage solutions or upgrading data integration processes.

The next step is to set clear objectives and assign leadership. Outline specific, measurable use cases that focus on ROI - think portfolio optimization or risk modeling - and ensure they align with the family’s broader goals. It’s equally important to appoint a senior leader or a dedicated team to manage the AI initiative. This leader will also ensure compliance with security protocols and regulatory requirements throughout the process.

Lastly, start small, evaluate progress, and scale gradually. Begin with straightforward automation projects to build trust and familiarity with AI. Once you’ve established a solid foundation, move on to more complex tools like machine learning. Launch pilot programs, track their performance closely, and make adjustments as needed. By maintaining consistent monitoring, conducting regular reviews, and upholding strong governance, you’ll set the stage for lasting success and meaningful returns on investment.

How can AI help family offices invest in deeptech more effectively?

AI equips family offices with powerful tools to make more informed decisions in deeptech investing. By processing massive datasets - ranging from patent filings and scientific studies to early-stage funding patterns - machine learning pinpoints technologies and startups with strong growth potential. This helps family offices zero in on opportunities that are more likely to yield solid returns.

But AI’s capabilities don’t stop at discovery. It also transforms portfolio management. Through simulations, AI evaluates risks and fine-tunes allocation strategies. It forecasts market trends, regulatory shifts, and adoption rates, enabling family offices to adjust their investments for better returns while keeping risks in check. On top of that, AI keeps an eye out for warning signs, such as sudden shifts in a startup’s spending habits or changes in its team structure, allowing for swift, proactive risk management.

With AI in their corner, family offices can confidently navigate the intricate world of deeptech, turning its unpredictable nature into measurable, profitable opportunities.