AI Resource Allocation Tools for Deeptech Investors

Overview of AI platforms that analyze patents, papers, and market data to help deeptech investors allocate capital, validate tech, and source deals.

AI Resource Allocation Tools for Deeptech Investors

Investing in deeptech is complex and resource-intensive. AI tools are transforming this process by analyzing massive datasets - like patents, market trends, and scientific papers - quickly and efficiently. Key platforms include Innovation Lens, DealPotential, PitchBook, Dealroom.co, and Affinity. Each tool offers unique features, such as predictive analytics, market insights, and relationship mapping, to help investors identify opportunities and allocate resources effectively. Here's a quick overview of their strengths:

- Innovation Lens: Focuses on early-stage research, technical feasibility, and R&D potential. Ideal for spotting untapped opportunities.

- DealPotential: Analyzes private companies, predicts valuations, and tracks market trends.

- PitchBook: Covers venture capital, private equity, and M&A with detailed data and emerging tech tracking.

- Dealroom.co: Strong in European markets, with tools for startup ecosystem mapping and predictive analytics.

- Affinity: Streamlines deal flow with relationship mapping and CRM automation.

These tools save time, reduce costs, and improve decision-making. However, challenges like data accuracy, integration issues, and high costs remain. For early-stage deeptech investors, Innovation Lens stands out with its focus on technical validation and market gaps.

1. Innovation Lens

Predictive Analytics

Innovation Lens sets the stage with its advanced predictive analytics, offering a cutting-edge benchmark for innovation intelligence. By leveraging 28 AI models, it automates processes like idea management and IP strategy. One standout tool, the Idea Scoring AI, evaluates research using over 50 criteria, including technical feasibility, market potential, and strategic alignment. Meanwhile, the R&D Project Predictor employs Random Forest and survival analysis techniques to forecast project success and monitor key milestones [2].

Data Scope and Sources

The platform taps into a vast, continuously updated database containing millions of scientific studies. This allows investors to validate early-stage research claims by cross-referencing a wide range of published work.

Deeptech-Specific Features

Innovation Lens shines in the realm of high-risk, high-reward projects. It identifies underexplored research areas and even generates "future abstracts" - previews of emerging scientific trends. These features give deeptech investors a head start in spotting potential breakthrough opportunities.

Integration and Customization

For enterprise users, Innovation Lens offers seamless integration via API. It also allows for tailored recommendations, enabling companies to align their resource allocation with specific strategic investment goals.

2. DealPotential

Predictive Analytics

DealPotential specializes in analyzing private companies using an extensive global database. With the help of AI, machine learning, and natural language generation, it evaluates over 7 million private companies worldwide [5]. Its algorithms are designed to predict next-round valuations and detect early funding signals, giving deeptech investors an edge in capital allocation [8].

The platform assesses companies using more than 15 key metrics, including estimated value and market alignment. DealPotential claims that targeting the top-performing companies based on these metrics can result in a 1.8x higher internal rate of return [5]. It also forecasts mergers and acquisitions (M&A) and tracks market trends, offering insights to guide strategic decisions [6]. This predictive focus is built on a robust and reliable data framework.

Data Scope and Sources

DealPotential gathers information from over 21,000 trusted sources, such as financial institutions, research organizations, and regulatory filings [4][5]. Unlike platforms relying on web scraping, DealPotential ensures all its data is sourced and includes a complete audit trail in its reports [4][8]. Each company profile features over 100 data points, covering areas like financial performance, operational details, investment history, and technology stacks [7]. For deeptech investors, the system also tracks "Total technologies detected" for every company in its database [4].

The platform doesn't stop there. It monitors news across 28 different categories, such as product launches and hiring trends, helping investors identify niche technologies before they become mainstream [5][7]. With daily updates to its global database, DealPotential offers real-time insights into hiring patterns, customer growth, and tech developments [4][7]. These frequent updates enhance its usability and integration potential.

Integration and Customization

DealPotential combines its features into a single, streamlined dashboard, eliminating the need for multiple data providers. A Silicon Valley VC investor shared:

"We could replace 40 data providers by using DealPotential" [4]

The platform's AI generates automated due diligence reports for all 7 million-plus companies in its database, cutting research time from weeks to under 10 minutes [5]. Pricing starts at $997 per user per month, with discounts available for larger teams [6].

3. PitchBook

Data Scope and Sources

PitchBook offers a comprehensive view of venture capital, private equity, and mergers and acquisitions (M&A) by combining proprietary datasets, automated news collection, and manual curation [12]. The platform spans eight distinct data categories, featuring detailed profiles on companies, deals, investors (including assets under management and dry powder), funds, and limited partners across private and public markets [12][14]. As of late 2025, more than 32,500 professionals worldwide rely on PitchBook, with its datasets updated six times daily [12][18]. A 2018 survey revealed that 86% of global venture capital investors use data to guide their decisions, emphasizing the importance of platforms like PitchBook in the investment landscape [12]. Dexter Braff, President of The Braff Group, shared his perspective:

"We rely on PitchBook to help us identify market trends and compare what is happening in the broad market to what we see in our niche health care services areas." [10]

With this solid data foundation, PitchBook delivers specialized tools designed to address the needs of deeptech investors.

Deeptech-Specific Features

For deeptech investors who demand precise market insights, PitchBook offers tailored tools focused on emerging technologies. The Emerging Spaces tool tracks investments across over 70 niche tech sectors, including LIDAR, quantum computing, and cellular agriculture [12]. It provides key metrics such as capital invested, median deal size, and post-money valuations for each sector. Additionally, the Market Maps feature uses machine learning to group companies by similarity, enabling investors to visualize sub-sectors within deeptech and assess competitive dynamics [12].

Another standout feature is the Emerging Tech Indicator (ETI), which analyzes seed and early-stage investments in frontier technologies like ethical AI, biotech, and alternative energy, helping investors pinpoint critical trends [13]. For example, in Q3 2024, AI and machine learning startups raised $2.0 billion across 42 early-stage deals [16]. In March 2023, PitchBook data highlighted Salesforce Ventures’ involvement in 140 VC deals for AI and machine learning startups, accounting for roughly 19% of its total investments at the time [19]. Brendan Burke, a PitchBook analyst, noted:

"Startups prioritizing ethical AI from square one can stand out in the rapidly evolving AI platform field." [19]

Update Frequency

PitchBook ensures its insights remain current through continuous monitoring and frequent updates. Its API allows investors to track financing activity and key events in real time [11]. Users can customize datasets for companies, deals, investors, and funds, which automatically sync with their internal systems or CRMs [11]. Additionally, PitchBook publishes quarterly research reports, such as the Emerging Tech Indicator and the PitchBook-NVCA Venture Monitor, offering macro-level analyses of the venture landscape [13][15].

In Q1 2025, the Emerging Tech Indicator reported a 50% year-over-year drop in seed and early-stage deal volume, though deal values stayed robust due to large investments in AI, alternative energy, and biotech [13]. Jay Santoro, Vice President at Tarsadia Investments, shared a practical example of PitchBook's utility:

"PitchBook had the contact information of the CEO and co-founder... I initiated a cold outreach using all the information I found within PitchBook, and ultimately, that effort led to a deal." [17]

Integration and Customization

PitchBook employs machine learning through its Suggestions tool to refine search results based on user criteria, making it easier to identify similar deeptech opportunities [18]. Advanced search filters allow users to narrow down results by keywords, industries, and verticals, helping them uncover niche opportunities [18]. Investors can also create custom peer groups and set up automated alerts for new funds or companies that match specific deeptech requirements [14].

Richard Li, Senior Market Research Analyst at MaRS Discovery District, highlighted the platform's adaptability:

"One of the best things about PitchBook is its ability to handle the variance we throw at it to get answers for startups. Our Capital Insights service includes a variety of data pulls and insights for each startup, which is assembled in a quick and scalable way." [15]

PitchBook is widely regarded as a trusted data provider, earning high ratings on professional review platforms like G2 and TrustRadius [9][14].

Investor Insights: Deep Tech Investing in the Age of AI

sbb-itb-5766a5d

4. Dealroom.co

Dealroom.co stands out as a platform offering a detailed, data-driven perspective on deeptech investments, following in the footsteps of platforms like PitchBook.

Data Scope and Sources

Dealroom.co tracks an impressive 3 million companies, providing over 100 data points per company. This includes data on 2.1 million startups and 640,000 funding rounds [20][26]. The platform uses machine learning and AI to gather public information from sources like news outlets, company filings, domain registries, and job boards [20]. What sets it apart is its collaboration with over 100 local governments, ministries, and trade organizations, granting access to verified primary data. According to the platform, it delivers up to 2.5 times more data on European venture capital rounds than its competitors [26].

Deeptech-Specific Features

Dealroom categorizes companies into deeptech sectors such as Quantum Computing, Space Tech, Semiconductors, and TechBio using its proprietary taxonomy. These companies are further assessed through the "Science Hubs" lens, which emphasizes university talent and patent activity [23][24][25]. For instance, within the Helsinki ecosystem, Dealroom has tracked $909.3 million in Industrial Technology investments and $526.3 million in Space Tech investments since 2020 [24].

The platform also offers "Dealroom Signal", a tool powered by predictive algorithms that identifies emerging companies and funding opportunities. As Dealroom explains:

"Through the Science Hubs lens, more emphasis is placed on deep tech, university talent and patents. Patent data combined with venture capital data paints a powerful picture of innovation." [25]

Update Frequency

To stay relevant in fast-moving tech ecosystems, Dealroom focuses on real-time data collection. Its "Live Dealroom Data" powers ecosystem dashboards, with some visuals updated to reflect the latest full quarter [24]. Data accuracy is ensured through a combination of automated AI classification and manual reviews by an in-house Intelligence Unit and analysts [20]. The platform describes its approach as follows:

"Real-time data and predictive technology are required, using powerful algorithms... historical data is no longer enough." [20]

Integration and Customization

Dealroom’s real-time insights support seamless portfolio targeting. Investors can use advanced tags, filters, and algorithmic tools to create tailored company lists that align with their deeptech investment strategies [21]. In March 2025, Dealroom published its fourth annual European Deep Tech Report in collaboration with Lakestar, Walden Catalyst, and Hello Tomorrow. This report explored how AI advancements have reshaped European deeptech priorities [22]. Additionally, Dealroom’s predictive algorithms highlight high-potential companies before they gain widespread attention [21].

5. Affinity

Affinity takes relationship data to the next level, offering a platform that doesn't just aggregate information but actively maps connections to optimize how resources are allocated. As a relationship-graph CRM, it automates the process of capturing data and provides actionable insights, making it easier to allocate resources effectively in the deeptech space. By using natural language processing to analyze over one trillion email and calendar interactions, Affinity pinpoints the most valuable connections to founders and decision-makers [3][29].

Predictive Analytics

Affinity’s AI-powered tools process massive amounts of data to guide smarter resource allocation. These tools provide predictions about market trends, startup valuations, and other insights to help replace guesswork with data-driven decisions [28]. One standout feature is Deal Assist, an AI chatbot designed to analyze unstructured data - such as pitch decks, financial statements, and meeting transcripts - to answer due diligence questions throughout the deal process. Additionally, the Industry Insights function generates competitor lists and keeps tabs on industry shifts, offering a clearer view of the competitive landscape [28].

Data Scope and Sources

Affinity's database is vast, covering more than 100 million companies and 250 million individuals. Every day, the platform syncs over one trillion emails and 18 million meetings, capturing interactions and enriching CRM records with external data from over 40 sources, including Crunchbase, Dealroom, and PitchBook [29].

"Processing vast unstructured data might be particularly relevant when you're looking for different signals... AI can play a really powerful role here." - Adam Perelman, Engineering Manager of ChatGPT at OpenAI [28]

Integration and Customization

More than half of the top 300 VC firms rely on Affinity, thanks to its seamless API integrations and dedicated Salesforce version. These integrations consolidate network and deal data, saving users over 200 hours of manual data entry each year [28][29]. Unlike platforms that focus on transactional data, Affinity emphasizes relational mapping to speed up deal flow using network intelligence. For instance, Motive Partners saw a 66% increase in the number of deals reviewed in a year, while MassMutual Ventures managed to source deals five times faster after adopting Affinity [29].

"There are tools like Affinity that are very close to offering a single source of truth that unifies different information. This is what I would look for. Keep the stack simple, as few tools as possible to try to get as much done as you can." - Andre Retterath, Partner at Earlybird Ventures [28]

Advantages and Disadvantages

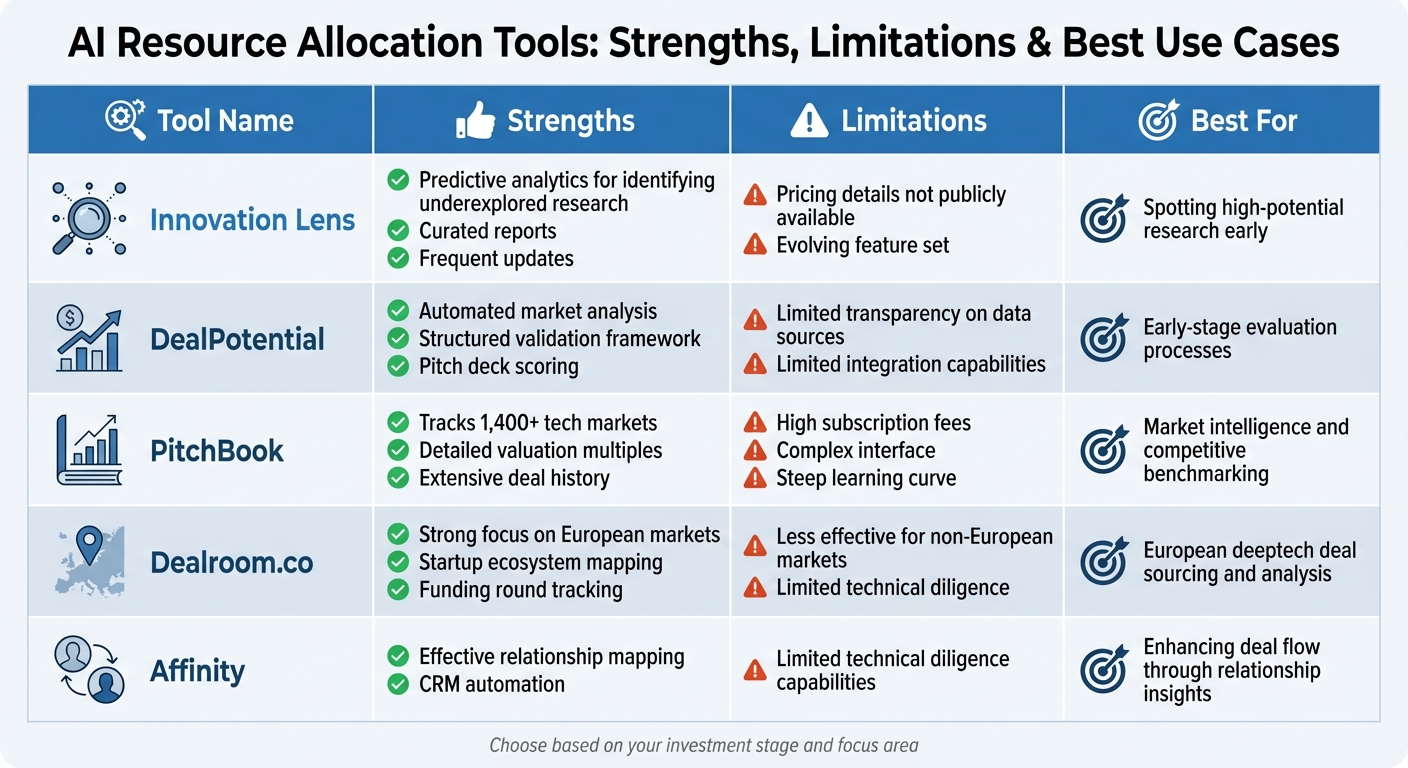

AI Resource Allocation Tools for Deeptech Investors Comparison Chart

This section provides an overview of the strengths and challenges associated with various AI resource allocation tools for deeptech investors.

AI-powered tools bring distinct benefits, but they also come with their own set of limitations. For instance, Innovation Lens stands out for its ability to identify high-potential, underexplored research areas using predictive analytics and curated reports. This makes it a valuable asset for spotting transformative projects early. Similarly, DealPotential and PitchBook offer robust market intelligence. PitchBook, in particular, tracks more than 1,400 tech markets and provides detailed valuation multiples - such as a striking 45x revenue multiple for some GenAI platforms [30][32]. Meanwhile, Dealroom.co has a strong focus on European markets, and Affinity excels in relationship mapping, streamlining deal flow.

However, these tools are not without challenges. A significant concern is the "black box" nature of many AI models, which lack transparency. This can make it difficult to justify decisions to stakeholders or compliance teams. As Sagar Agrawal from Qubit Capital cautions:

"If you treat [predictive analytics] like a magic box, it will eventually bite you" [33].

Data accuracy is another issue. In fast-evolving deeptech sectors, outdated information can sometimes surface [34]. Integration challenges also arise when tools have limited compatibility with CRM systems, leading to workflow silos.

Cost and scalability are additional hurdles. For example, while PitchBook offers extensive data, its high subscription fees and complex interface can be daunting for new users. Smaller firms often lack the expertise in data science, machine learning, and finance needed to effectively manage these systems [33]. Compliance is another growing concern, with 57% of investment advisers identifying AI usage as a top issue [33].

Deeptech investments, which often require 5–10 years to bring products to market and allocate 40–60% of capital to R&D - six times more than traditional tech sectors [31] - pose unique challenges. While AI-driven due diligence can cut analysis time by up to 40% [27], this efficiency is of limited use if the scientific claims behind a project are not rigorously validated.

To help you navigate these tools, the table below summarizes their key strengths, limitations, and ideal use cases:

| Tool | Strengths | Limitations | Best For |

|---|---|---|---|

| Innovation Lens | Predictive analytics for identifying underexplored research; curated reports; frequent updates | Pricing details not publicly available; evolving feature set | Spotting high-potential research early |

| DealPotential | Automated market analysis; structured validation framework; pitch deck scoring | Limited transparency on data sources and integration capabilities | Early-stage evaluation processes |

| PitchBook | Tracks 1,400+ tech markets; detailed valuation multiples; extensive deal history | High subscription fees; complex interface; steep learning curve | Market intelligence and competitive benchmarking |

| Dealroom.co | Strong focus on European markets; startup ecosystem mapping; funding round tracking | Less effective for non-European markets; limited technical diligence | European deeptech deal sourcing and analysis |

| Affinity | Effective relationship mapping; CRM automation | Limited technical diligence capabilities | Enhancing deal flow through relationship insights |

Conclusion

Choosing the right platform largely depends on your investment focus. Tools like PitchBook, Dealroom.co, Affinity, and DealPotential excel at analyzing financial metrics and established company data, catering primarily to the later stages of investment. However, they don't address the critical upstream scientific layer where groundbreaking deeptech opportunities often begin to take shape.

This is where Innovation Lens stands out. It focuses on deeptech by assessing technical feasibility, analyzing patent landscapes, and uncovering R&D potential. The platform identifies "white space" opportunities - those gaps in the market ripe for innovation - before startups even emerge. By doing so, it offers impressive efficiency, saving 60–75% of the time typically required and delivering a return of 300–500% on investment [2].

Beyond these evaluations, Innovation Lens provides advanced technical insights that go far beyond traditional deal-flow tools. Its Patent Intelligence AI identifies licensing opportunities and flags infringement risks, while the Resource Allocation Optimizer uses constraint programming to accelerate market entry [2]. For investors managing complex capital structures, these tools offer the technical validation that financial metrics alone can't provide [1].

The platform's unique value is well summarized by Giulia Spano, PhD, and Nicola Marchese, MD, from The Scenarionist:

"Scientific legitimacy is finally translating into investability. Smart money isn't waiting for Nobel-grade novelty - it's backing throughput curves" [1].

Innovation Lens helps investors pinpoint projects that combine scientific credibility with real-world deployment potential. It strikes a balance between groundbreaking discoveries and incremental improvements through multi-objective portfolio optimization [2].

For deeptech investors focused on early-stage discoveries, technical validation, and untapped research areas, Innovation Lens offers an unmatched suite of features. Its emphasis on the early stages of innovation makes it a must-have tool for those looking to stay ahead in the deeptech space.

FAQs

How does Innovation Lens uncover untapped opportunities in deeptech research?

Innovation Lens leverages AI-driven analytics to uncover underfunded yet promising areas within deeptech research. By sifting through extensive datasets - ranging from grant proposals and scientific papers to patent records and funding patterns - the platform identifies gaps where future breakthroughs are most likely to surface.

Using predictive modeling and scoring metrics such as innovation potential, strategic importance, and estimated impact, Innovation Lens zeroes in on high-potential research areas that might otherwise remain overlooked. This data-centric method equips deeptech investors with the insights they need to confidently target transformative opportunities.

What features does Innovation Lens offer to support early-stage deeptech investors?

Innovation Lens delivers AI-driven tools designed to make early-stage deeptech investing more efficient and precise. By integrating with ORCID, the platform verifies project teams, ensuring their credibility. It also evaluates the scientific strength of projects by analyzing patents, academic publications, and citation networks. This approach helps investors zero in on teams and projects with solid technical foundations and clear market potential.

Beyond initial investments, the platform provides post-investment insights through comprehensive dashboards. These tools allow investors to track research progress, monitor collaboration networks, and stay updated on patent developments. Additionally, its research mapping features reveal global trends in emerging technologies and spotlight overlooked opportunities, helping investors confidently prioritize and manage impactful deeptech initiatives.

How does Innovation Lens maintain accurate data and integrate diverse information for users?

Innovation Lens uses cutting-edge methods to deliver precise data and integrates information from various sources effortlessly. With the help of AI-powered analytics and predictive tools, it provides reliable insights specifically designed for deeptech investors, research institutions, and grantmakers.

This strategy enables users to make informed choices by highlighting promising yet often overlooked research areas, all while reducing the chances of relying on incomplete or flawed data. By emphasizing accuracy and ease of use, Innovation Lens helps its users uncover impactful opportunities with confidence.