Research Portfolio Diversification: Ultimate Guide

Learn how to strategically diversify research portfolios to reduce risks and enhance innovation across scientific disciplines and technological sectors.

Research Portfolio Diversification: Ultimate Guide

Research portfolio diversification is about spreading investments across various scientific fields, tech sectors, and innovation stages to minimize risk and maximize returns. Unlike traditional financial portfolios, this approach focuses on funding scientific studies, tech development, and innovation projects. Here's what you need to know:

- What It Is: Allocating resources across different research areas like quantum computing, biotechnology, and AI commercialization.

- Why It Matters: Reduces risks in high-stakes areas like deeptech, where long timelines and uncertainties are common.

- Key Challenges: Balancing resources, managing expertise across fields, and aligning project timelines.

-

Strategies:

- Invest across disciplines to manage risk and create synergies.

- Diversify tech applications and industries to tap into varied markets.

- Balance funding across early, growth, and mature stages of research.

- Tools: Use models like Monte Carlo simulations, predictive analytics, and patent landscape analysis to optimize decisions.

A well-structured portfolio combines diverse disciplines, industries, and development stages, ensuring resilience and readiness for future opportunities.

Main Strategies for Research Portfolio Diversification

Creating a research portfolio that balances risk and drives progress requires a thoughtful approach. The best strategies focus on three main areas: scientific disciplines, technology sectors, and development stages. Each of these dimensions plays a unique role in shaping a portfolio that can handle uncertainties while tapping into opportunities for groundbreaking discoveries. These approaches align with the broader goal of managing risk while fostering innovation across a variety of research areas.

Disciplinary Diversification

Investing across multiple scientific fields is a smart way to manage risk. Relying too heavily on one discipline can leave organizations exposed to setbacks specific to that field - whether it’s a major study being invalidated, regulatory changes, or shifts in technology that render certain methods outdated.

The most effective portfolios bring together related fields that can complement and strengthen one another. For example, advancements in materials science often accelerate developments in quantum computing, while progress in computational biology can fuel new approaches in drug discovery. This interconnected strategy creates a ripple effect where success in one area can spark breakthroughs in another - something single-discipline approaches often miss.

Cross-disciplinary investments amplify progress across multiple fields at once.

Geographic and institutional diversity also plays a big part in this. Different regions and research institutions bring unique strengths, methods, and perspectives to the table. This variety helps avoid the blind spots that can arise when research is concentrated in similar settings or follows uniform methods.

Striking the right balance between breadth and depth is key. Spreading resources too thin across many disciplines can dilute impact, while focusing too narrowly increases vulnerability to risks tied to a single field. Successful organizations often center their efforts around three to five core disciplines while making smaller exploratory investments in emerging or adjacent fields. This approach keeps the portfolio nimble and better equipped to handle risks.

Technology and Sector Diversification

Diversification isn’t just about scientific fields - it also extends to the practical applications and industries where research outcomes will eventually make an impact. This strategy acknowledges that groundbreaking technologies often find unexpected uses across various sectors, and market dynamics can differ widely between industries.

A balanced approach involves spreading investments across technology domains (horizontal diversification) and within specific applications of a domain (vertical diversification). For instance, horizontal diversification might include investments in areas like biotechnology, quantum computing, advanced materials, and renewable energy. Vertical diversification, on the other hand, could focus on different applications within a single area, such as using quantum computing for cryptography, financial modeling, or drug discovery.

Timing is crucial here. Different industries have unique adoption cycles, regulatory hurdles, and competitive landscapes. For example, healthcare innovations often face longer approval processes but offer more stable opportunities once they’re cleared. Meanwhile, consumer technology might hit the market faster but comes with higher competition and volatility.

Platform technologies - like machine learning algorithms, gene editing tools, or advanced manufacturing techniques - are particularly valuable in this context. These foundational innovations can be applied across multiple industries, offering a way to spread risk while opening doors to numerous opportunities.

Cross-sector innovations, such as military technologies finding new uses in civilian markets, highlight the benefits of keeping a broad view. Organizations that stay attuned to developments across various sectors are better positioned to identify these unexpected opportunities and act on them.

Stage-Based Diversification

While diversification across disciplines and sectors lays the groundwork, balancing investments across different development stages adds another layer of refinement. This approach helps optimize risk and return while ensuring consistent performance over time. Each stage of research and development comes with its own set of risks, timelines, and potential rewards.

- Early-stage investments focus on fundamental discoveries with high risk but potentially transformative outcomes. These typically require smaller initial funding but may need long-term commitment with uncertain results.

- Growth-stage investments target projects that have shown feasibility and are moving toward application. These require larger funding but offer clearer timelines and metrics for success. Examples include scaling lab discoveries, conducting pilot studies, or building prototypes.

- Mature-stage investments concentrate on the commercialization and fine-tuning of proven technologies. While these involve lower risk and more predictable returns, they also generate revenue in the short term, which can fund earlier-stage projects.

Successful portfolios spread investments across all stages, adjusting allocations based on strategic goals and market conditions.

Pipeline management is critical in this process. Organizations need systems to monitor projects as they move through various stages, making informed decisions about funding, resource allocation, and direction. This requires robust evaluation tools to assess progress and potential consistently across stages. A well-managed pipeline ensures the portfolio remains agile and prepared for both risks and opportunities.

Analysis Tools and Methods for Portfolio Optimization

Managing research investments effectively requires not just diversification but also a solid framework of analytical tools to evaluate and refine allocations. In today's fast-changing research environment, these tools help organizations assess risks, identify new opportunities, and maintain a well-balanced portfolio.

Quantitative Models for Portfolio Analysis

Quantitative models play a key role in analyzing and optimizing portfolios. For instance, the Herfindahl-Hirschman Index (HHI) is a useful metric for measuring risk distribution - lower HHI values indicate better diversification.

Modern portfolio theory can also be adapted to research investments, taking into account the often-overlooked connections between disciplines. By considering these relationships, organizations can better allocate resources across fields.

Another approach is using risk-adjusted return calculations to evaluate how well diversification strategies are performing. Specialized performance ratios can compare the potential impact of a portfolio with its volatility. This is particularly helpful for research investments, which often take years to bear fruit.

Simulation techniques, like Monte Carlo simulations, allow organizations to test how portfolios might respond to different scenarios. This helps identify vulnerabilities before they become problems.

Models similar to Value-at-Risk (VaR) have also been tailored for research portfolios. These models estimate the likelihood that certain programs might fall short of their goals within a given timeframe, offering insights that guide resource allocation and set realistic expectations.

All of these quantitative tools naturally lead to predictive analytics, which takes portfolio analysis a step further by anticipating future trends.

Predictive Analytics for Trend Identification

Staying ahead in innovation often depends on spotting emerging research trends early. Predictive analytics makes this possible by analyzing massive amounts of data, such as publication patterns, citation networks, and keyword usage. These insights can reveal shifts in research priorities before they become widely recognized.

Patent landscape analysis is another valuable method. By studying patent filing trends, inventor networks, and technology categories, organizations can map out the competitive landscape and find promising "white spaces." Combining this with publication data provides a more complete picture of research activity.

Machine learning adds another layer of precision by detecting weak signals in funding or collaboration data. These subtle indicators can point to major developments on the horizon. Similarly, natural language processing tools can extract insights from research abstracts, grant proposals, and technical reports.

One particularly powerful application of predictive analytics is cross-domain pattern recognition. This involves identifying how progress in one area might spark advancements in another. For example, breakthroughs in quantum computing could open up new possibilities in fields like cryptography or pharmaceuticals.

Another tool, social network analysis, examines collaboration patterns among researchers. This can uncover key influencers, emerging partnerships, and new opportunities for collaboration that might otherwise go unnoticed.

While predictive analytics highlights future trends, continuous monitoring ensures portfolios remain aligned with evolving conditions.

Portfolio Monitoring and Rebalancing

Given the long-term nature of scientific research, monitoring and rebalancing strategies must be tailored to accommodate slower timelines compared to traditional investments. Continuous monitoring ensures that portfolios stay aligned with strategic goals as circumstances change.

Establishing key performance indicators (KPIs) is essential. These should include both historical metrics - such as publication counts and citation rates - and forward-looking indicators like patent applications or collaboration growth.

Regular portfolio reviews are another critical practice. These reviews evaluate how investments are performing relative to objectives, whether they align with new opportunities, and how risks are distributed. By systematically assessing these factors, organizations can make informed decisions about reallocating resources.

Unlike financial portfolios, rebalancing research portfolios doesn't involve selling off underperforming assets. Instead, organizations must decide whether to strengthen, redirect, or phase out certain initiatives. This requires careful consideration of sunk costs, remaining potential, and opportunity costs.

Trigger-based rebalancing provides a structured way to respond to major developments. For instance, breakthroughs in technology, regulatory changes, or shifts in competition can act as triggers for portfolio reviews, reducing reliance on reactive decision-making.

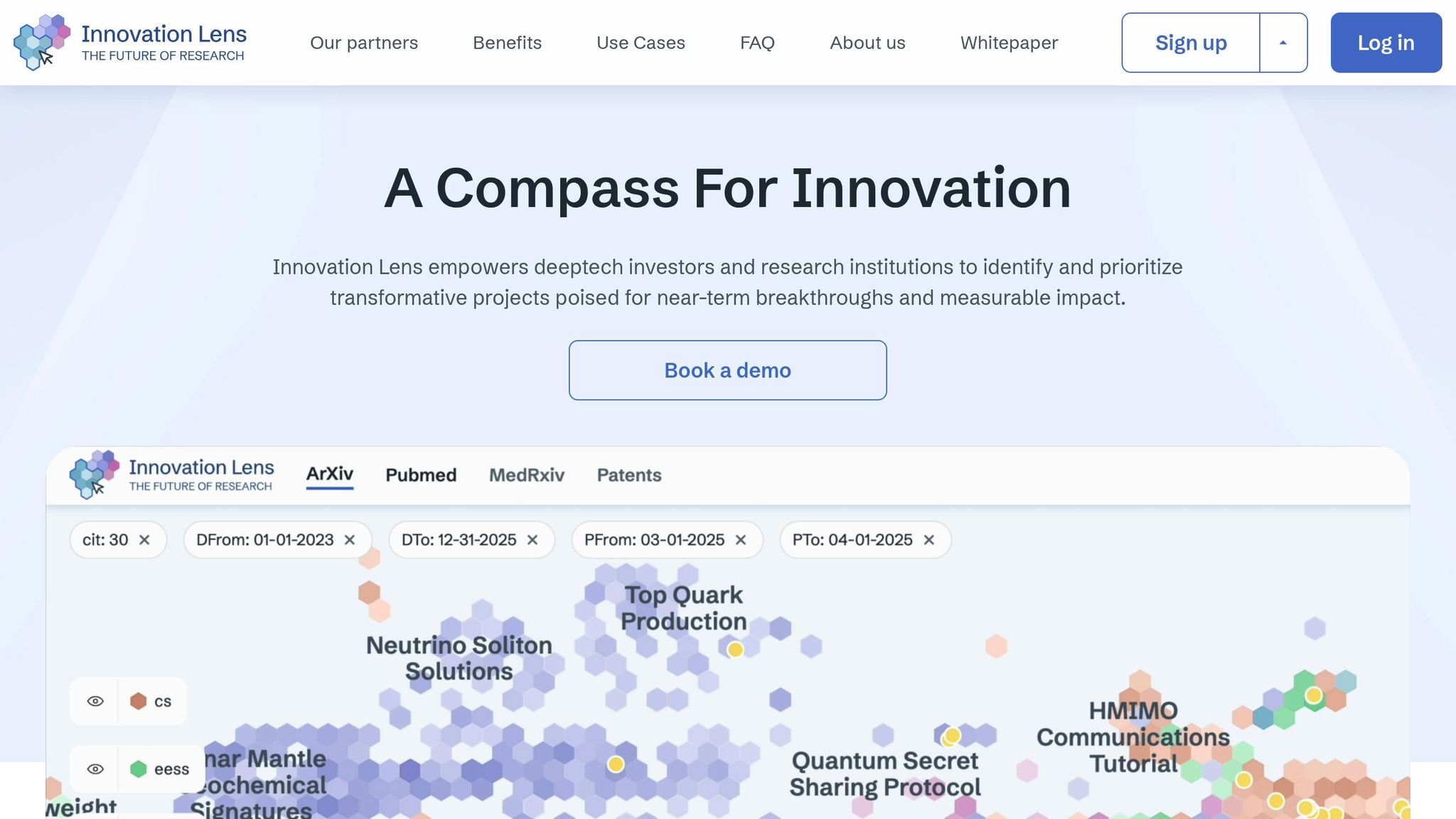

Tools like Innovation Lens simplify portfolio monitoring by offering weekly updates and tailored recommendations. These tools help organizations track how their investments align with new trends and provide alerts for emerging opportunities, ensuring agility in a dynamic research environment.

Lastly, scenario planning exercises test how portfolios might perform under different conditions. From groundbreaking discoveries to funding cuts, these exercises help organizations prepare for a range of possibilities, guiding both immediate actions and long-term strategies.

Together, these monitoring and rebalancing practices ensure that research portfolios remain adaptable and well-positioned in an ever-evolving landscape.

Case Studies: Success Stories in Diversified Research Portfolios

When it comes to diversification strategies and analytical methods, real-world examples bring these concepts to life. They demonstrate how strategic diversification can turn high-risk research investments into powerful drivers of innovation. By balancing their portfolios, organizations not only reduce risk but also achieve groundbreaking advancements through interdisciplinary collaboration. These triumphs span industries like technology, healthcare, and academia.

Take, for instance, a leading technology conglomerate that reorganized its operations to better manage multiple research divisions. This approach led to significant progress in areas such as autonomous systems and computational science. Similarly, a global healthcare firm embraced diversification to advance drug development while enhancing medical manufacturing processes simultaneously. Meanwhile, academic institutions have made strides by encouraging interdisciplinary collaborations, blending expertise from traditionally separate disciplines to achieve remarkable breakthroughs.

Comparison of Diversification Approaches

The table below highlights different diversification strategies across industries, detailing their benefits, challenges, and ideal applications.

| Approach | Examples/Industry Sectors | Key Advantages | Main Challenges | Best For |

|---|---|---|---|---|

| Broad Multi-Sector | Large multinational tech companies | Reduces risk and uncovers unexpected synergies | Complex management and resource allocation | Organizations with large capital and diverse operations |

| Focused | Specialized healthcare or biotech firms | Utilizes deep domain expertise and efficient resources | Vulnerable to sector-specific risks | Companies with strong expertise in a niche area |

| Stage-Based | Investment firms and incubators | Balances risk-adjusted returns across project stages | Requires diverse skills and precise timing | Firms targeting innovation at various development stages |

| Geographic | Global corporations in varied markets | Mitigates regional risks and taps into local innovations | Cultural and regulatory challenges | Companies with global operations |

| Technology Platform | Major tech platform providers | Scalable infrastructure with cross-functional benefits | Managing tech evolution and integration | Businesses built around digital ecosystems |

Lessons Learned from Successful Portfolios

Examining successful diversified research portfolios reveals some key takeaways:

- Stick to your strengths while branching out: Expanding into related fields can spark innovation without straying too far from core competencies.

- Encourage structured collaboration: Rely on formal mechanisms for cross-disciplinary work rather than leaving it to chance.

- Tailor your metrics: Mature projects and emerging initiatives often need different evaluation methods to measure success effectively.

- Balance risk profiles: Combine projects with varying levels of risk to ensure that setbacks in one area are offset by stability elsewhere.

- Invest in shared resources: Scalable platforms and infrastructure can serve multiple projects, cutting costs and enhancing efficiency. Timing diversification during industry shifts or market transitions can also amplify its impact.

These insights emphasize the importance of intentional and flexible diversification in driving research and innovation forward.

sbb-itb-5766a5d

Optimizing Research Investments with Innovation Lens

Building a well-rounded research portfolio demands tools that can sift through vast scientific data and pinpoint emerging opportunities early. Innovation Lens simplifies this process by offering data-driven insights, enabling investors and institutions to make smarter, more informed decisions across various disciplines, technologies, and stages of innovation. Below, we explore its core features, practical benefits, and how it integrates seamlessly into organizational workflows to optimize research investments.

Features That Drive Diversification

Innovation Lens tackles the challenges of research portfolio diversification with a combination of advanced tools and predictive analytics. Its predictive analytics engine identifies trends by analyzing extensive datasets, helping investors balance their portfolios across both emerging and established research areas.

The platform’s curated reports provide a roadmap for diversification by spotlighting transformative projects across multiple scientific domains. These reports illustrate how advancements in one field can ripple into others. For instance, breakthroughs in materials science may simultaneously influence renewable energy storage, medical device innovation, and aerospace engineering.

Another standout feature is custom recommendations, which align diversification strategies with specific risk profiles and investment timelines. By evaluating how individual projects complement existing portfolio holdings, the system helps avoid an over-concentration in superficially varied but fundamentally similar research areas.

The future abstracts feature offers a forward-looking perspective, highlighting under-the-radar research topics that have yet to gain widespread attention. This tool is particularly valuable for identifying early-stage opportunities, where competition for funding is low, but the potential for returns is high.

Benefits for Smarter Decision-Making

Beyond its impressive functionality, Innovation Lens delivers clear advantages for decision-makers by reducing risks, boosting returns, and uncovering groundbreaking discoveries.

For risk reduction, the platform provides a comprehensive analysis of both competitive and emerging fields, helping investors avoid overexposure to any single research direction. Weekly insights offer actionable intelligence, ensuring timely adjustments. If a specific field becomes oversaturated or encounters technical roadblocks, the system flags these issues early, enabling strategic rebalancing.

On the returns side, Innovation Lens excels at identifying high-potential, underexplored research areas. By analyzing large datasets like PubMed and arXiv, it uncovers promising directions with strong fundamentals that haven’t yet attracted significant competition. This allows early investments to yield outsized returns.

Perhaps most exciting is the platform’s ability to reveal interdisciplinary connections that human analysts might miss. These connections often lead to transformative innovations by blending insights from different fields in unexpected ways. Thanks to its validation against extensive scientific databases, the system ensures these connections represent real opportunities rather than superficial patterns.

Seamless Workflow Integration

Diversified portfolios demand constant monitoring and adjustment. Innovation Lens integrates effortlessly into this process, enabling organizations to automate research tracking and support dynamic rebalancing strategies.

Through API access, the platform can feed research insights directly into an organization’s internal systems. This real-time integration ensures continuous evaluation of new developments against existing investments, supporting proactive adjustments to maintain diversification.

More than just a data feed, the platform is customizable to fit specific investment frameworks. Whether an organization focuses on geographic distribution, technology platforms, or stage-based allocation, Innovation Lens adapts to enhance existing strategies rather than replace them.

For institutions managing large, complex portfolios, the ability to track and analyze multiple projects simultaneously is invaluable. The platform keeps a close eye on how individual investments contribute to overall portfolio balance, preventing the gradual drift toward over-concentration that can occur when attractive opportunities are pursued without considering their cumulative impact on diversification.

Conclusion and Key Takeaways

The Importance of Diversification in a Changing Landscape

In the ever-evolving world of deeptech - where fields like AI, biotechnology, quantum computing, and materials science intersect - diversification is more than just a strategy; it’s a safeguard. By spreading investments across various disciplines, you can reduce risks while staying open to groundbreaking opportunities. It’s a way to ensure that your portfolio remains resilient, even when some areas face setbacks, while also positioning yourself to benefit from emerging advancements.

A well-rounded portfolio strikes a balance between established fields and newer, high-potential areas. It mixes early-stage research with more developed technologies and taps into innovation hubs worldwide. After all, today’s obscure research could become tomorrow’s dominant industry, while some seemingly promising fields might hit unexpected roadblocks. Diversification ensures you’re prepared for both scenarios and allows for growth regardless of which technologies ultimately take the lead.

Additionally, building interdisciplinary connections can amplify the impact of your investments. When breakthrough areas collaborate, they often create synergies that drive even greater innovation. With these principles in mind, let’s explore actionable steps to refine your research portfolio.

Steps to Optimize Your Research Portfolio

To fine-tune your portfolio and align it with the strategies discussed, consider the following approaches:

- Maintain a balance across disciplines: Spread investments across fundamental sciences, applied research, and engineering. Avoid the temptation to concentrate solely on trending fields, as this can come at the expense of supporting foundational research that often underpins future breakthroughs.

- Diversify by research stage: Combine early-stage exploratory projects with later-stage developments. Early-stage investments may promise higher returns, but they also carry greater risks, making a mix of both essential for stability and growth.

- Broaden geographic reach: Invest in regions known for their strengths in specific areas. For instance, Silicon Valley excels in software and semiconductors, Boston leads in biotechnology, Europe is advancing clean energy, and Asia is a hub for manufacturing innovations. Geographic diversity reduces exposure to local challenges while leveraging regional expertise.

- Use data-driven insights: Platforms like Innovation Lens can help you track research trends, identify interdisciplinary opportunities, and maintain portfolio balance. Analytical tools like these ensure you stay informed about emerging developments and adjust your investments accordingly.

- Rebalance regularly: As some research areas grow and others shrink, periodic reviews are crucial to maintaining your portfolio’s intended structure. This prevents overconcentration in a few dominant areas and allows for ongoing alignment with your goals.

- Measure performance holistically: Evaluate success not just through financial returns but also through scientific impact. Metrics like citation counts, patent filings, and technology transfer activities provide valuable insights into the broader influence of your investments and can guide future decisions.

FAQs

What makes research portfolio diversification different from traditional financial portfolio diversification?

Research portfolio diversification emphasizes distributing investments across scientific fields, technological areas, and various stages of innovation. The goal? To drive forward new discoveries while minimizing the risks tied to research and development efforts.

On the other hand, traditional financial portfolio diversification focuses on spreading investments across different asset types, industries, and geographic locations. This approach aims to maximize financial returns while managing monetary risk. While both strategies share a focus on balancing risk and reward, research portfolios are specifically designed to fuel progress and innovation, rather than simply generating financial gains.

Can you provide examples of cross-disciplinary investments that have driven breakthroughs in multiple fields?

Crossing the boundaries between different fields has often sparked major advancements by merging diverse areas of expertise. Take, for example, the collaboration between biotechnology and artificial intelligence (AI). This partnership has sped up drug discovery, cutting both the time and expense involved in developing treatments. It’s a game-changer for the pharmaceutical world.

Another exciting area is the fusion of materials science and renewable energy. This combination has led to innovations like more efficient solar panels that are also cheaper to produce, making renewable energy more accessible.

One more standout example is the integration of nanotechnology with healthcare. This has paved the way for targeted drug delivery systems, which can zero in on specific areas in the body, improving treatment outcomes for patients. These cases show how blending knowledge from different disciplines can open up new opportunities and push progress across industries at the same time.

How can organizations leverage predictive analytics to identify future research trends and enhance their investment strategies?

Organizations are tapping into predictive analytics to dig into historical data, spot new patterns, and predict future trends in research and innovation. By leveraging tools like machine learning algorithms and statistical models, decision-makers can pinpoint opportunities in less-explored areas and stay ahead of changes in scientific priorities.

To make the most of their research portfolios, organizations should pair predictive insights with a strategy that balances diversification. This means spreading resources across various disciplines, technologies, and phases of innovation. Consistently reviewing and adjusting these portfolios based on predictive data helps ensure investments stay in step with changing trends and deliver the best possible returns.