Concentrated vs. Diversified Deeptech Portfolios

Choose between high-conviction concentrated bets with bigger upside and volatility or diversified deeptech portfolios for steadier, risk-managed returns.

Concentrated vs. Diversified Deeptech Portfolios

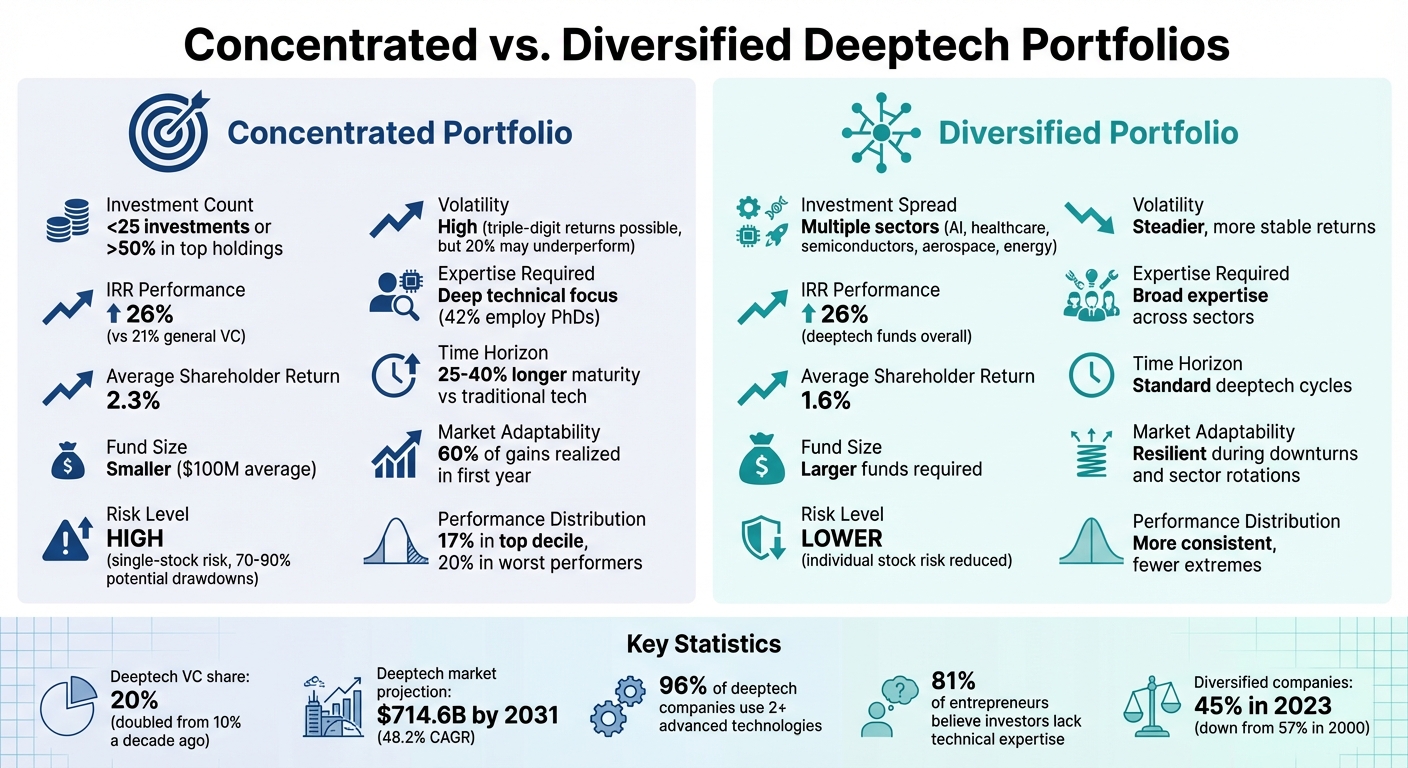

When investing in deeptech, you face two main strategies: concentrated portfolios or diversified portfolios. Each has its own risks, rewards, and challenges. Concentrated portfolios involve fewer investments, focusing on high-conviction opportunities, while diversified portfolios spread risk across multiple sectors. Here's what you need to know:

-

Concentrated Portfolios

- Focus on fewer than 25 investments or allocate over 50% of funds to top holdings.

- Offer higher returns (26% IRR vs. 21% for general VC funds) but come with increased volatility.

- Require deep technical expertise and long-term commitment, as deeptech ventures often take 25–40% longer to mature.

- High risks can lead to extreme outcomes - both positive and negative.

-

Diversified Portfolios

- Spread investments across sectors like AI, healthcare, and semiconductors.

- Provide steadier returns (1.6% average shareholder return vs. 2.3% for concentrated).

- Lower individual investment risk but may dilute focus and expertise.

- Perform better during economic downturns but can lag in bullish markets.

Quick Comparison

| Feature | Concentrated Portfolio | Diversified Portfolio |

|---|---|---|

| Risk | High single-stock risk | Lower individual stock risk |

| Return Potential | Higher upside, more volatile | Steadier, lower upside |

| Fund Size | Smaller funds ($100M avg.) | Larger funds required |

| Expertise | Requires deep technical focus | Broad expertise across sectors |

Your choice depends on your risk tolerance, expertise, and investment goals. Concentrated strategies demand focus and patience, while diversified approaches balance risk across sectors.

Concentrated vs Diversified Deeptech Portfolio Comparison

Ignite VC: Democratizing Venture Capital & Deep Tech Investing with Matt Caspari | Ep79

sbb-itb-5766a5d

1. Concentrated Deeptech Portfolios

Let’s dive deeper into what makes concentrated deeptech portfolios tick and the trade-offs they bring to the table. On average, deeptech-focused funds manage about $105 million, which is noticeably smaller than the $148 million average for generalist venture capital funds[4]. With deeptech investments often surpassing $100 million per company[1], these smaller fund sizes naturally limit how many companies each fund can back.

Risk-Return Tradeoff

The focused nature of these portfolios creates a unique performance profile. Over the past five years, deeptech-focused funds have delivered a weighted average internal rate of return (IRR) of 26%, outpacing the 21% IRR of traditional venture capital funds[1]. Similarly, concentrated portfolios have achieved an average relative total shareholder return of 2.3%, compared to 1.6% for more diversified portfolios[5]. But these higher returns come with a catch: increased volatility. While a concentrated strategy can produce triple-digit returns when bets succeed, it also exposes investors to significant losses when things go south[2].

Deeptech ventures, in particular, carry substantial scientific and engineering risks. Although these ventures often tackle fundamental societal challenges, which may reduce market risk, the inherent technical uncertainties make them a high-stakes game[4]. This level of volatility emphasizes the importance of specialized expertise to evaluate and manage these investments effectively.

Portfolio Focus and Expertise

The high risks in deeptech demand deep technical know-how. A striking 81% of deeptech entrepreneurs believe that most investors lack the scientific or engineering expertise required to assess their ventures properly[4]. This is especially critical given that 96% of deeptech companies use at least two advanced technologies, and 66% depend on more than one cutting-edge innovation[4]. To fill this gap, 42% of deeptech investors employ PhDs to conduct due diligence[4].

This focus on expertise is mirrored in discretionary managers who limit their attention to a small number of companies. As economist John Maynard Keynes wisely pointed out:

I am quite incapable of having adequate knowledge of more than a very limited range of investments. Time and opportunity do not allow more.[2]

Fund Size and Investment Count

Among deeptech investors, 22% maintain portfolios where 80% or more of their investments are concentrated in the sector[8]. There’s a clear pattern here: higher concentration often correlates with smaller fund sizes. For example, in the most concentrated 10% of funds, 42% manage less than $100 million in assets[6]. These smaller funds, which make larger individual investments, can only support a handful of companies. This focused approach aligns with the significant financial and technical resources that deeptech ventures require, particularly in their early stages[4].

To better handle the long development cycles typical of deeptech, many emerging funds are now designed with lifetimes of 10 to 15 years and fund sizes ranging from $150 million to $300 million[4].

Adaptability to Market Trends

Concentrated portfolios offer both flexibility and risk. They can quickly seize opportunities in niche deeptech sectors but are also more exposed to the dangers of chasing speculative trends that may unravel dramatically[2][6]. Since deeptech funding stages typically take 25% to 40% longer to mature compared to traditional tech[1], managers of concentrated portfolios must commit to long-term challenges. This requires what Boston Consulting Group calls "patient capital"[4].

Interestingly, concentrated funds are overrepresented among both the best and worst performers. About 17% of these funds land in the top decile, while 20% fall among the worst, reflecting the pronounced volatility that comes with this strategy[6].

2. Diversified Deeptech Portfolios

Let’s take a closer look at how diversified deeptech portfolios manage risk. Unlike concentrated strategies, which place significant bets on a small number of companies, diversified portfolios spread investments across multiple sectors - think aerospace, energy, and advanced materials. This strategy aligns with Warren Buffett's idea of diversification as "a protection against ignorance" [2]. It acknowledges that even the most well-researched deeptech ventures are not immune to unexpected technical or market challenges.

Risk-Return Tradeoff

Diversified portfolios tend to smooth out the dramatic ups and downs often seen with concentrated strategies. On average, they delivered a relative total shareholder return of 1.6%, compared to 2.3% for concentrated portfolios [5]. While their returns may not always hit the same highs, they offer a safety net during economic downturns. Markets often reward diversified portfolios during crises, recognizing their lower risk profile [5].

That said, there’s a downside: the "diversification discount." In bullish markets, investors often favor concentrated growth, which can lead to diversified portfolios being valued lower than the sum of their individual investments [5]. Still, the deeptech sector itself provides a natural layer of diversification. Over the past decade, deeptech's share of total venture capital funding has doubled from 10% to 20% [1]. With its moderate valuations and emerging fields, deeptech offers a hedge against overheated software markets [1]. This balance of risk and return shifts attention to the challenge of managing expertise across such a broad range of sectors.

Portfolio Focus and Expertise

Diversified portfolios come with their own set of challenges, particularly when it comes to bandwidth. Deeptech investments demand rigorous scientific due diligence and deep sector-specific expertise, which can be hard to maintain across multiple industries.

Interestingly, the benefits of diversification on fund performance drop off when a manager’s expertise is stretched too thin [9]. While diversification helps mitigate the high failure rates common in deeptech ventures [7], it can also dilute the specialized knowledge and networks that add real value. In fact, research suggests there’s a sweet spot for diversification. Beyond a certain point, spreading investments too widely can hurt returns because the lack of focus starts to outweigh the benefits [7].

Fund Size and Investment Count

Diversified portfolios often require larger funds to support their broader investment strategies. Over time, the share of companies classified as diversified has fallen - from 57% in 2000 to 45% in 2023 - reflecting a growing preference for focused strategies during extended bull markets [5]. Gradual adjustments, measured by Herfindahl-Hirschman Index changes of less than 0.34, tend to yield better shareholder returns than abrupt shifts [5].

Adaptability to Market Trends

One of the key strengths of diversified portfolios is their ability to adapt to sector rotations, reducing the risks associated with over-concentration. No single sector dominates consistently. For example, Technology led in four of the past eight years, but Energy, Health Care, and Telecommunications have also taken turns at the top [3]. This unpredictability makes a case for spreading investments across multiple deeptech sectors. Investors are increasingly targeting "innovation themes" like AI infrastructure, precision medicine, and advanced manufacturing to capture growth opportunities across different economic cycles [3].

The deeptech market itself is on a rapid growth trajectory, projected to reach $714.6 billion by 2031 with a compound annual growth rate of 48.2% [10]. This creates numerous opportunities for diversified portfolios. Companies with dual-use applications - serving both commercial and government or defense needs - are particularly appealing, as they reduce reliance on a single market outcome [10]. This adaptability is becoming more critical as deeptech ventures align with government policies focused on national security and technological independence [10].

Advantages and Disadvantages

When it comes to building a deeptech portfolio, concentrated and diversified approaches each bring their own strengths and challenges. Here’s how they stack up:

| Feature | Concentrated Portfolio | Diversified Portfolio |

|---|---|---|

| Risk Exposure | High single-stock risk, with potential drawdowns of 70–90% or more. A single failure in a key investment can result in significant financial losses [2]. | Lower individual stock risk, providing more stability and protecting capital from extreme fluctuations [2]. |

| Return Potential | Offers higher potential returns by focusing on a few "best ideas", with an average relative total shareholder return (rTSR) of 2.3%. However, up to 20% of these portfolios may underperform [5][6]. | Provides steadier returns, with an average rTSR of 1.6%. Diversified deeptech funds have shown a 26% internal rate of return (IRR) over five years, compared to 21% for traditional venture capital [1][5]. |

| Adaptability | Relies heavily on the success of a few investments. Market recognition tends to be slower, with only about 60% of gains realized in the first year [5]. | Highly resilient during sector rotations and economic crises, allowing it to capitalize on opportunities across innovation cycles [3][5]. |

| Resource Allocation | Requires intense focus, dedicating up to 100 times more effort per asset. This focus accelerates Design-Build-Test-Learn cycles for physical products [2][4]. | Spreads resources across multiple projects, often leveraging collaborations with universities and research labs. While scalable, this approach may dilute specialized expertise [4]. |

Concentrated portfolios often operate at the extremes. For example, Bill Ackman’s Pershing Square lost nearly $4 billion on Valeant Pharmaceuticals after the stock plummeted by 93% from its peak [2]. Similarly, Alexander Darwall’s fund suffered when it had 17% of its holdings in Wirecard, which lost 98% of its value following a fraud scandal [2].

"Diversification is a protection against ignorance."

– Warren Buffett, Chairman, Berkshire Hathaway [2]

On the other hand, diversified portfolios trade some upside potential for increased stability. This approach is particularly useful in deeptech, where 83% of ventures involve physical products with intricate unit economics [4], and investments often take 25% to 40% longer to mature compared to traditional tech [1].

Ultimately, your choice between these strategies should align with your risk tolerance and expertise. Concentrated portfolios require deep scientific insight and a high tolerance for volatility, while diversified portfolios demand the ability to manage complexity across various sectors. Each approach offers unique advantages, setting the stage for leveraging specialized platforms to fine-tune portfolio strategies in the deeptech space.

Using Innovation Lens for Portfolio Strategy

When it comes to refining your portfolio strategy, Innovation Lens offers a specialized tool that builds on the strengths and challenges investors face. Whether you’re focusing on a concentrated portfolio with a few high-conviction bets or spreading investments across multiple deeptech sectors, this platform provides a solid analytical foundation. Its patent-pending algorithm identifies research topics that are both cutting-edge and underexplored, while also being statistically likely to deliver breakthroughs within 24 months[11]. This makes it an asset for both focused and diversified approaches, aligning data-driven insights with your investment goals.

For those pursuing concentrated strategies, Innovation Lens excels at identifying high-potential niches with minimal competition. The platform’s predictive capabilities are impressive - delivering performance that’s 300% above baseline for topics in PubMed and about 100% better in Physics and Computer Science[11]. This allows investors to make high-conviction bets based on statistically valid insights rather than gut feelings. One standout feature is its ability to generate "future abstracts" - essentially forecasting articles that haven’t been written yet, offering a glimpse into potential breakthroughs[11].

"Our patent-pending algorithm is able to reliably indicate topics that lie close enough to existing research to be well-supported, and far enough away to be innovative."

– Innovation Lens[11]

For diversified portfolios, Innovation Lens simplifies the complexity of managing multiple directions. By processing tens of millions of studies across fields like Physics, Computer Science, and Medicine, it helps investors prioritize promising opportunities[11]. Backed by an analysis of over 40 million studies from PubMed, arXiv, and the USPTO, the platform highlights untapped areas in emerging fields such as quantum computing, synthetic biology, and advanced materials.

Another advantage is its cost-effectiveness. The service fee is far lower than what you’d typically spend on a single seed round investment[11]. Investors can access its insights through customized reports, interactive dashboards, and API integration, all designed to enhance due diligence. For pricing and further details, you can reach out at info@innovationlens.org.

Conclusion

Deciding between a concentrated or diversified deeptech portfolio comes down to aligning your investment approach with your goals and tolerance for risk. A concentrated portfolio offers the potential for higher returns but comes with increased volatility, while a diversified portfolio provides more stability, albeit with a trade-off in potential upside.

Success in either approach hinges on disciplined, data-driven decision-making. For concentrated strategies, having genuine expertise is critical. Over the past five years, deeptech funds have achieved a weighted average internal rate of return (IRR) of 26%, outperforming the 21% IRR seen in traditional venture capital[1]. On the other hand, diversified portfolios benefit from focusing on innovation themes like AI, semiconductors, and life sciences, which capture opportunities that cut across traditional sector boundaries[3]. If you're considering a shift toward a more concentrated strategy, gradual changes are key - moderate adjustments (HHI shifts of less than 0.34) have been shown to deliver better shareholder returns than abrupt transitions[5].

To manage these trade-offs effectively, specialized tools can make all the difference. Platforms like Innovation Lens provide data-driven insights that help mitigate the risks of overconcentration or excessive diversification. Whether you're placing high-conviction bets or spreading investments across multiple sectors, the platform's predictive analytics and ability to uncover underexplored research areas enable smarter decision-making. With deeptech now securing a steady 20% share of all venture capital funding - double what it was a decade ago[1] - having tools that simplify complexity is becoming indispensable.

Both concentrated and diversified strategies can thrive in the deeptech space when supported by consistent execution and access to reliable insights into where the next breakthroughs are likely to emerge.

FAQs

What are the risks and benefits of investing in a concentrated deeptech portfolio?

Investing heavily in a select few deeptech companies can lead to big rewards, especially since groundbreaking innovations often create transformative market opportunities. With strong intellectual property and deep technical know-how, a focused portfolio has the potential to outperform a more diversified one. This strategy allows investors to zero in on high-potential technologies that could become market leaders.

That said, this approach also carries serious risks. Concentrated portfolios are more exposed to volatility, where challenges like regulatory shifts or changes in technology leadership can have a major impact. Relying heavily on just a handful of investments can magnify losses, making this method inherently riskier. To help investors navigate these risks while pursuing the rewards, Innovation Lens provides tools such as predictive analytics and expert insights. These resources make it easier to spot promising deeptech projects and evaluate their potential, supporting a more disciplined and well-informed investment approach.

What are the benefits and trade-offs of diversifying a deeptech portfolio?

Diversifying a deeptech portfolio is a smart way to manage risk. Instead of putting all your eggs in one basket, spreading investments across multiple ventures can help cushion the blow if one project faces setbacks. This strategy creates a more stable portfolio by balancing out fluctuations from individual investments.

That said, there’s a trade-off. A diversified portfolio might not deliver the same sky-high returns as a concentrated one. Concentrating on just a few high-conviction investments can lead to bigger rewards if those projects succeed. But the flip side? It also comes with higher stakes - failure in a single technology could significantly impact the portfolio.

Tools like Innovation Lens can be game-changers here. They help investors spot promising, underexplored research areas, making it easier to craft portfolios that strike the right balance - capturing the growth potential of deeptech while keeping risks in check.

How does expertise influence the management of concentrated vs. diversified deeptech portfolios?

Expertise is a key factor in shaping the success of both concentrated and diversified deeptech investment strategies.

Concentrated portfolios demand a high level of specialized knowledge in specific technologies, markets, and funding requirements. With fewer investments, each decision carries significant weight, and even a single misjudgment can lead to substantial losses. This means investors must have a sharp technical understanding and the ability to assess high-risk opportunities with confidence.

In contrast, diversified portfolios distribute risk across a range of projects, reducing dependence on any single technology or analysis. While this approach minimizes the impact of individual decisions, it still requires a strong grasp of the deeptech ecosystem. Investors need to navigate factors like extended development timelines, unique funding structures, and regulatory hurdles. Tools such as Innovation Lens can be invaluable here, offering curated insights and analytics to support smarter decision-making.

In essence, concentrated portfolios rely heavily on deep, domain-specific expertise and conviction, while diversified strategies prioritize systematic risk management and a broader evaluation skill set. Both approaches aim to unlock the high-reward opportunities within the deeptech sector, but the path to success varies significantly.