How to Evaluate Deeptech Investment Opportunities

Learn how to evaluate deeptech investments by assessing technology feasibility, market potential, scalability, and regulatory challenges.

How to Evaluate Deeptech Investment Opportunities

Investing in deeptech is a high-risk, high-reward endeavor requiring both scientific knowledge and business acumen. Unlike software startups, deeptech ventures involve long development timelines, higher upfront costs, and scientific uncertainty. Key areas include quantum computing, advanced materials, biotech, AI hardware, and clean energy.

To succeed, you need to:

- Evaluate Technology Feasibility: Use the Technology Readiness Level (TRL) framework and conduct rigorous scientific due diligence to ensure the core science works and can scale.

- Analyze Market Potential: Assess market size, unmet needs, customer acquisition strategies, and competitive dynamics. Consider regulatory challenges and timing.

- Assess Scalability: Confirm the technology can transition from lab to large-scale production without major manufacturing, energy, or material issues.

- Leverage Partnerships: Collaborate with industry, academic, and government entities for validation, resources, and market entry.

Deeptech investing demands patience, long-term vision, and a structured approach to managing risks, making it essential to combine rigorous technical checks with financial discipline and data-driven tools.

Deep Tech Decoded: A Strategic Investor’s Guide

Evaluating Technology Feasibility

Before diving into deeptech investments, it’s crucial to confirm that the science behind the technology is solid. This step isn’t about market demand or business strategy - it’s about ensuring the technology can actually deliver on its promises.

Evaluating whether a technology is feasible requires more than just reviewing pitch decks. Think of it as a scientific audit, where the goal is to determine whether an innovation can transition from a laboratory idea to a commercially viable product.

Using the Technology Readiness Level (TRL) Framework

The Technology Readiness Level (TRL) framework offers a standardized way to gauge how developed a technology is. Originally created by NASA, the TRL system uses a scale from 1 to 9, with TRL 1 representing the earliest stages of research and TRL 9 indicating a fully operational system.

- TRL 1-3: This range focuses on basic research and proof-of-concept work. At this stage, the emphasis is on fundamental scientific principles and early experiments. While the risks are highest here, the potential rewards can be enormous if the science proves sound.

- TRL 4-6: Here, development and testing take center stage. Prototypes are built and evaluated in relevant environments, attracting investor interest despite lingering challenges.

- TRL 7-9: These levels involve system integration, advanced testing, and full-scale deployment. While technologies at this stage are closer to market readiness, they often require significant capital to scale.

Understanding a technology's TRL level is essential for assessing risks and planning funding timelines. For example, a TRL 3 quantum computing venture will have very different needs and risks compared to a TRL 7 materials company gearing up for commercial production.

Pinpointing a technology’s TRL naturally leads to deeper due diligence to verify the underlying scientific claims.

Scientific Due Diligence and Verification

Scientific due diligence is critical to avoid investing in technologies that may not work as claimed. Start by reviewing all available technical materials, such as white papers, peer-reviewed studies, patent filings, and internal research documents. Look for consistency across these sources, and flag any gaps or contradictions in the claims.

Patent analysis is especially important. Don’t just examine the patents held by the company - also review the broader patent landscape in the field. This ensures the technology is based on solid prior research and isn’t at risk of infringement issues.

"For deep tech VCs, getting the science wrong can be a costly mistake. A single overlooked limitation can lead to years of wasted funding or stalled progress." - Mike Hinckley, Founder of Growth Equity Interview Guide, Venture Partner at Velocity Fund [1]

After reviewing documents, bring in external experts for independent validation. These advisors, with deep expertise in the relevant field, can identify flaws or limitations that might not be apparent to generalist investors. They can also provide context on how the technology compares to other approaches in the industry.

Whenever possible, seek independent data to verify key claims. This could involve third-party testing or consulting researchers with experience in similar technologies.

Finally, evaluate the scientific leadership team. Look into the academic credentials, publication records, and prior commercial experience of the founders and key technical staff. The most successful deeptech companies blend top-tier scientific expertise with a clear understanding of the challenges involved in bringing research to market.

Assessing Scalability from Lab to Market

Once the science checks out, the next step is to evaluate whether the technology can scale from the lab to meet market demands. Success in a controlled lab environment doesn’t always translate to large-scale viability. Scaling up often reveals hidden challenges that can derail even the most promising ventures.

One major hurdle is manufacturing constraints. A process that works efficiently in the lab might face obstacles when scaled to industrial production. Factors like material availability, specialized equipment needs, and quality control can all become significant challenges.

Energy efficiency is another key consideration. A technology that uses acceptable amounts of power during lab tests might become prohibitively expensive when energy costs are factored in at scale.

Material limitations can also pose problems. Some technologies rely on rare or expensive materials that are fine for prototypes but impractical for mass production. It’s important to assess whether the technology can transition to using more affordable or abundant materials without sacrificing performance.

Maintaining quality control and consistency at scale is another challenge. While lab conditions allow for tight control over variables, commercial production often involves greater variability. Technologies sensitive to environmental factors like temperature or humidity may face additional difficulties.

Infrastructure requirements also play a role. Does the technology need specialized facilities, unique equipment, or highly trained personnel? These factors can significantly impact both the timeline and the capital required for scaling.

Finally, don’t overlook regulatory hurdles. Technologies in sectors like healthcare, aerospace, or automotive often face strict regulations that can extend development timelines and increase costs. It’s essential to account for these challenges early in the scalability analysis.

Analyzing Market Potential and Commercial Pathways

Once you've confirmed both feasibility and scalability, the next step is to dive into evaluating the market opportunity. Deeptech ventures often aim to disrupt established industries or take root in emerging markets, making thorough market analysis not just helpful but essential.

Assessing market potential isn’t just about spotting a big addressable market. It’s about understanding whether the technology can realistically carve out market share, navigate regulatory challenges, and form the partnerships needed to succeed commercially.

Calculating Market Size and Identifying Unmet Needs

Estimating Total Addressable Market (TAM) in deeptech is far from straightforward. Unlike consumer apps with predictable adoption patterns, deeptech markets are often shaped by complex B2B dynamics, lengthy sales cycles, and entrenched competitors.

Start by examining the current market size, its growth trajectory, and whether the technology has the potential to create entirely new markets. Deeptech often transforms workflows or enables applications that were previously out of reach.

Focus on investments addressing major pain points that existing solutions fail to resolve. These gaps often represent the best opportunities for deeptech to make a meaningful impact.

Market timing plays a pivotal role. If a technology is introduced too early, adoption can stall; too late, and the space might already be dominated by competitors. Assess whether the market conditions, industry readiness, and regulatory environment align with the technology’s timeline.

Another critical factor is the customer acquisition strategy. Deeptech companies often need to educate their market about new approaches, which can significantly extend sales cycles. Make sure there’s a practical plan in place for reaching and converting customers.

Pricing power is equally important. Deeptech solutions that deliver significant performance gains or cost savings can often command premium prices. Verify that the technology’s value aligns with what customers are willing to pay.

Don’t ignore competitive dynamics. While deeptech startups might initially operate in a niche with little direct competition, larger players often enter the space once they see the opportunity. Assess the company’s ability to maintain its edge over time.

Finally, consider how regulatory factors might shape market entry and growth.

Understanding Regulatory Requirements

Regulatory compliance is a make-or-break factor for deeptech ventures, especially in highly regulated industries like healthcare, energy, automotive, and aerospace. These sectors often have lengthy and costly approval processes that can significantly affect timelines and budgets.

For instance:

- Healthcare technologies require FDA approval to demonstrate safety and efficacy.

- Energy solutions often need environmental impact assessments and safety certifications.

- Automotive systems must meet rigorous safety standards across multiple global markets.

- Aerospace technologies face added challenges like export controls and security requirements.

Understanding the regulatory timeline is crucial for planning investments. These timelines directly impact both capital needs and potential returns.

Look for companies with strong regulatory expertise on their teams. This might include individuals with in-depth knowledge of the approval processes or connections with skilled regulatory consultants. Underestimating the complexity of compliance can lead to costly delays.

If the company plans to operate internationally, factor in global regulatory requirements. Different regions often have unique standards, which can increase both costs and complexity.

Often, the most effective regulatory strategies involve partnerships, which can also play a broader role in a startup’s success.

Partnerships and Ecosystem Support as Success Indicators

Once the technology’s feasibility and market potential are clear, strategic partnerships can solidify a deeptech company’s path forward. These relationships provide validation, technical expertise, distribution channels, and sometimes even funding.

- Industry partnerships with established players can fast-track market entry. Large corporations bring resources, industry knowledge, and customer connections that startups may lack. However, evaluate these partnerships carefully - some may be genuinely beneficial, while others could impose limitations.

- Academic collaborations remain valuable even after the initial R&D phase. Universities often provide access to specialized equipment, cutting-edge research, and skilled talent. Such partnerships can also boost credibility with both investors and customers.

- Government support through grants, contracts, or initiatives like SBIR grants in the U.S. can offer both funding and validation. This often signals that government agencies see the technology as strategically important.

- Supply chain partnerships are critical for startups requiring specialized materials or manufacturing processes. Securing reliable suppliers early can help avoid delays and quality issues during scaling.

- Customer partnerships and pilot programs provide direct market validation. Companies that actively engage potential customers during development not only refine their product but also demonstrate demand.

- The quality of the investor syndicate matters too. Experienced deeptech investors bring more than money - they offer industry connections, technical insights, and guidance through complex challenges. Their involvement can signal confidence in both the team and the technology.

Review the terms and exclusivity of key partnerships. While some relationships can open doors, others might impose restrictions that limit future flexibility. Understanding these trade-offs is crucial for evaluating long-term potential.

Finally, consider the company’s location. Geographic ecosystem strength can make a big difference. Startups based in hubs like Silicon Valley, Boston, or other global innovation centers often benefit from better access to talent, partners, and funding opportunities.

sbb-itb-5766a5d

Managing Risks and Financial Metrics

When evaluating deeptech ventures, balancing technical and financial considerations is key to managing the unique challenges these investments bring. With scientific and engineering hurdles often at the forefront, a structured approach to risk management is a must.

Prioritizing Technical Due Diligence

Deeptech projects often come with intricate complexities. To address this, it's essential to thoroughly verify scientific claims and assess the technology's feasibility. This isn't just about checking boxes - it's about identifying potential risks early and taking steps to address them. Think of technical due diligence as a proactive way to manage uncertainties and build confidence in the technology.

Applying Financial Discipline

Alongside technical evaluations, sound financial decision-making plays a critical role. Aligning capital investments with the technology's potential ensures resources are used wisely. By combining financial analysis with technical insights, you can better navigate risks and set the foundation for sustainable growth.

Using Data-Driven Tools for Investment Decisions

Once you've set up solid methods for managing technical risks and evaluating financial metrics, the next step is leveraging data-driven tools to sharpen your investment decisions. Deeptech investments, in particular, benefit from tools that analyze scientific data and uncover patterns that traditional methods might miss. These tools form the backbone of a more predictive and measurable investment strategy.

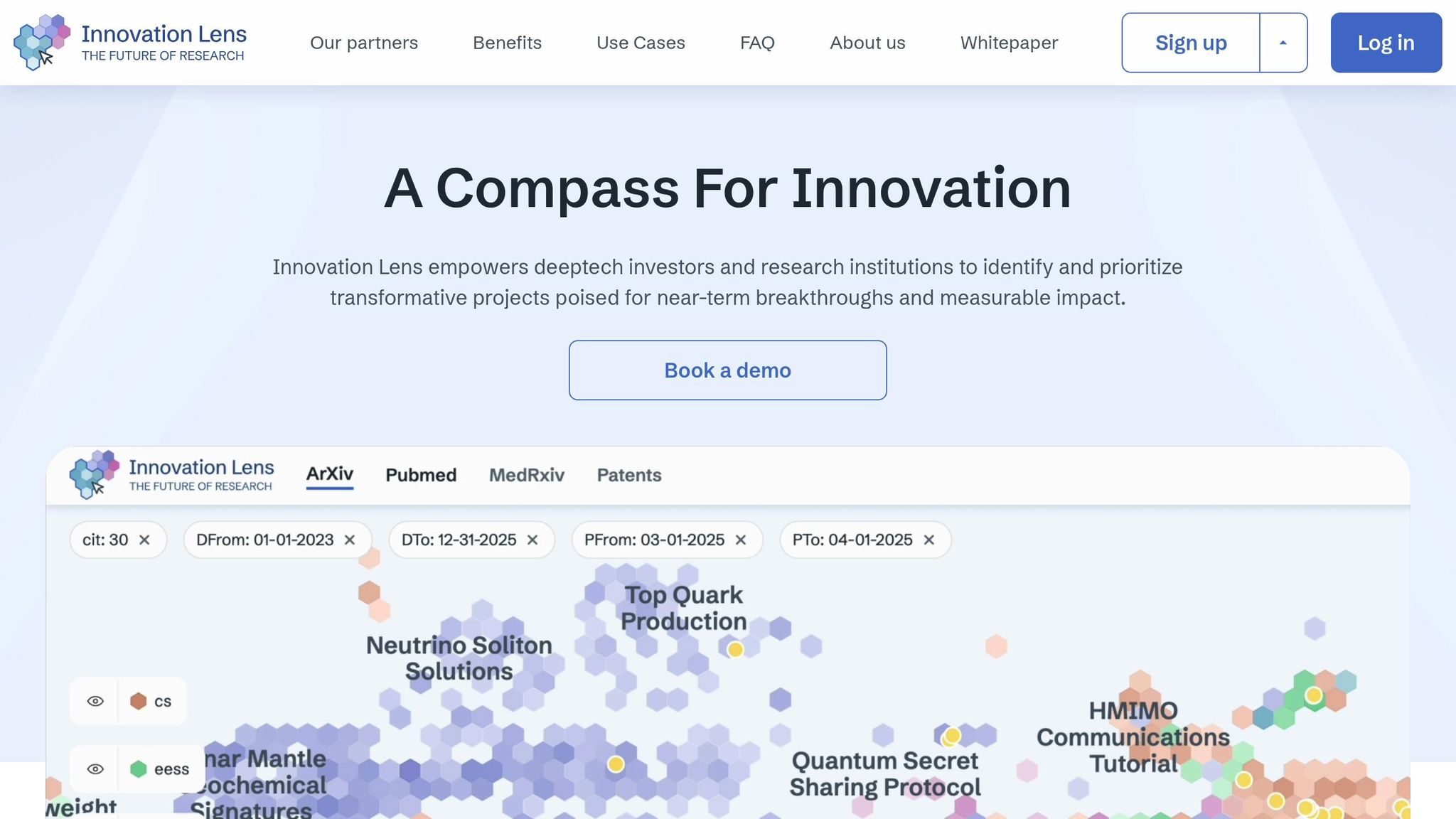

How Innovation Lens Helps Deeptech Investors

Data-driven insights are the perfect complement to thorough technical and financial evaluations, especially in the deeptech space. Innovation Lens tackles the unique challenges of deeptech investing by using predictive analytics to process vast amounts of information from sources like PubMed and arXiv. Its algorithms prioritize funding opportunities by ranking technologies based on their transformative potential. On top of that, curated reports provide critical insights into competitiveness, regulatory hurdles, and market readiness.

One standout feature is the platform's ability to create future abstracts, which predict emerging research trends. This gives investors a head start in identifying opportunities with high potential, long before they hit mainstream awareness.

This structured, data-driven approach allows investors to move beyond relying solely on gut instincts or personal networks. By turning complex scientific data into clear, actionable insights, these reports help assess both the technical strengths and market potential of new technologies.

Adding Data-Driven Insights to Your Investment Strategy

Incorporating Innovation Lens into your investment process can validate technology trends against extensive research databases, keeping you informed and ahead of the curve. Weekly updates and tailored recommendations ensure your strategy stays aligned with the latest developments in the research landscape. Plus, API access makes it easy to integrate these insights into your existing systems.

For portfolio management, these tools are invaluable. They help you track the competitive environment surrounding your investments, identify potential acquisition targets, and spot emerging technologies that could either complement or disrupt your current holdings. This ongoing flow of intelligence strengthens both risk management and value creation within deeptech portfolios.

Conclusion: Managing Deeptech Investment Complexity

Deeptech investments require a departure from traditional evaluation methods, given their unique challenges. These ventures often involve intricate technical hurdles, significant R&D demands, and extended development timelines, which call for more nuanced and informed investment strategies [1][4].

The frameworks discussed earlier emphasize the need for a strategic approach. With longer development cycles and higher risks, conducting thorough due diligence - covering scientific, technical, and commercial aspects - is crucial. This meticulous process forms the foundation for leveraging insights derived from data-driven tools [1][3].

Investors in deeptech must possess a long-term vision and an ability to navigate uncertainty [1]. The global deeptech investment market is expected to grow from $36.2 billion in 2023 to $127.8 billion, showcasing the sector's vast potential. However, tapping into these opportunities requires patience and sophisticated strategies for managing risks.

The integration of data-driven tools with advanced evaluation techniques represents a significant shift in deeptech investing [2][3][5]. These tools offer detailed insights to validate technology claims, analyze competitive landscapes, and uncover new opportunities. When paired with rigorous due diligence, they create a well-rounded framework for tackling the complexities of deeptech investments. Building strategic partnerships further strengthens this approach, helping investors navigate challenges effectively.

Collaboration plays a pivotal role in mitigating risks. Working closely with founders, syndicates, and government initiatives accelerates the journey from lab discoveries to commercial success [1]. This collective effort bridges the gap between groundbreaking innovations and tangible market impact.

FAQs

How can investors use the TRL framework to evaluate a deeptech startup's technology readiness?

Investors can use the Technology Readiness Level (TRL) framework to methodically assess a deeptech startup's progress, tracking its journey from early research stages to full-scale commercialization. The framework divides this process into nine levels, providing a clear view of the technology's maturity and development status.

Knowing a technology's TRL helps investors evaluate its practicality, spot potential risks, and estimate the time and resources required to bring it to market. This organized approach supports informed, data-backed decisions when tackling the complexities of deeptech investments.

What challenges do deeptech companies face when moving from prototypes to commercial production?

Deeptech companies face a unique set of challenges when moving their ideas from the lab to large-scale commercial production. One major obstacle is managing the technical complexity of their innovations, which often require advanced expertise and precision. On top of that, these ventures must tackle extensive R&D demands, ensuring their solutions are not only groundbreaking but also practical for real-world use. And then there’s the task of making sure these innovations can scale effectively to meet market demands.

But that’s not all. Deeptech startups often struggle with securing the funding needed to support their long and resource-intensive development cycles. They also have to navigate the maze of regulatory approvals and build the necessary infrastructure to bring their products to life. Tackling these issues takes careful planning, the right partnerships, and a strong focus on creating solutions that can grow sustainably over time.

How do regulatory requirements affect the costs and timelines of deeptech startups, and what strategies can help overcome these challenges?

Regulatory requirements often pose hurdles for deeptech startups, especially in tightly regulated sectors like biotech or energy. These industries demand strict adherence to approval processes and compliance standards, which can lead to longer timelines and increased costs.

To tackle these challenges effectively, startups can take several steps:

- Dive into regulatory research early: Understanding the specific requirements upfront can prevent unexpected surprises later.

- Bring in seasoned advisors: Professionals with a background in navigating complex regulations can provide invaluable guidance.

- Structure funding around milestones: Aligning financial planning with key regulatory checkpoints ensures resources are available when needed most.

By addressing these obstacles head-on, startups can navigate the regulatory maze more efficiently and keep their projects on track.